Why Major Investors Are Quietly Pouring Billions Into Biomethanol

The global energy landscape is undergoing a monumental transformation. As climate change accelerates and the world races to decarbonize, investors and industry leaders are searching for the next big breakthrough in renewable energy. While solar, wind, and hydrogen often steal the headlines, a quieter revolution is taking place in the world of biomethanol—a renewable, low-carbon alternative to traditional fossil fuels. Behind the scenes, major investors are pouring billions into biomethanol, seeing it as a linchpin in the transition to a cleaner, more sustainable future.

But what exactly is biomethanol? Why is it suddenly attracting so much capital? And what does this mean for the future of energy, transportation, and heavy industry? In this in-depth exploration, we’ll uncover why biomethanol is emerging as a star player in the green transition, the forces driving investment, and what the future holds for this versatile biofuel.

Understanding Biomethanol: The Basics

Before diving into the investment frenzy, it’s crucial to understand what biomethanol is and why it’s so important.

What Is Biomethanol?

Biomethanol is a form of methanol produced from renewable sources such as agricultural waste, forestry residues, municipal solid waste, or even captured carbon dioxide combined with hydrogen from renewable electricity. Unlike conventional methanol, which is typically made from natural gas or coal, biomethanol is considered a sustainable and climate-friendly alternative.

How Is Biomethanol Produced?

There are several pathways to produce biomethanol, including:

- Gasification of Biomass: Organic matter is heated in a low-oxygen environment to produce synthesis gas (syngas), which is then converted into methanol.

- Anaerobic Digestion: Organic waste is broken down by microorganisms to produce biogas, which can be reformed into methanol.

- Power-to-Methanol: Renewable electricity is used to split water into hydrogen, which is then combined with captured CO2 to synthesize methanol.

Each method has its own advantages, but all share the goal of turning waste or renewable resources into a high-value, low-carbon fuel.

Why Biomethanol? The Unique Advantages

Biomethanol stands out among alternative fuels for several reasons:

1. Significant Carbon Reduction

One of the most compelling reasons for the surge in biomethanol investment is its ability to drastically reduce greenhouse gas emissions. When produced from waste or renewable sources, biomethanol can cut lifecycle CO2 emissions by up to 80% compared to fossil-based methanol. This makes it an attractive option for industries under pressure to decarbonize.

2. Versatility Across Sectors

Biomethanol isn’t just a fuel. It’s a highly versatile chemical feedstock that can be used in:

- Transportation: As a direct fuel or blended with gasoline, diesel, or marine fuels.

- Chemicals: As a building block for plastics, paints, adhesives, and more.

- Power Generation: In fuel cells or as a backup for renewable energy.

- Hydrogen Production: Methanol can be reformed into hydrogen for use in fuel cells.

This wide range of applications makes biomethanol a strategic asset for investors looking to diversify across sectors.

3. Compatibility With Existing Infrastructure

Unlike some alternative fuels that require new infrastructure, biomethanol can often be used in existing pipelines, storage tanks, and engines with minimal modifications. This lowers the barrier to adoption and accelerates market penetration.

4. Circular Economy Potential

Biomethanol production can utilize waste streams that would otherwise contribute to landfill or pollution, turning liabilities into valuable assets. This supports a circular economy and aligns with global sustainability goals.

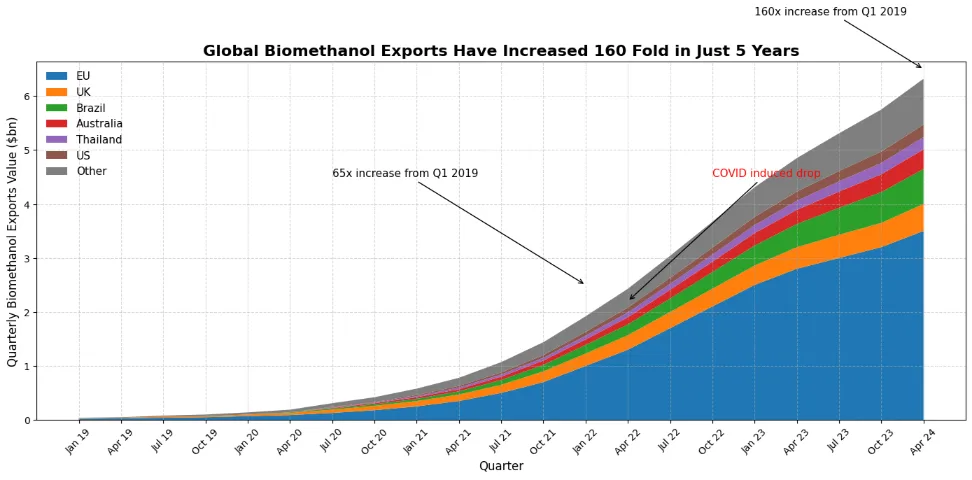

The Global Biomethanol Market: A Snapshot

The biomethanol market is on a steep upward trajectory. According to industry analysts, the global market for biomethanol is projected to grow from $254.6 billion in 2025 to $631.1 billion by 2035, at a compound annual growth rate (CAGR) of 9.5%. This explosive growth is being driven by several converging trends:

- Stricter emissions regulations

- Rising demand for sustainable fuels

- Technological breakthroughs

- Corporate sustainability commitments

Let’s dig deeper into why major investors are betting big on biomethanol.

The Forces Driving Billions Into Biomethanol

1. The Race to Decarbonize

Governments, corporations, and consumers are demanding rapid action on climate change. The transportation and industrial sectors—responsible for a significant share of global emissions—are under particular scrutiny. Biomethanol offers a practical, scalable solution for decarbonizing these hard-to-abate sectors.

Policy Support

- European Union: The EU’s Green Deal and Fit for 55 package mandate aggressive reductions in carbon emissions, with specific targets for renewable fuels in transportation and industry.

- United States: The Inflation Reduction Act and various state-level incentives are spurring investment in low-carbon fuels, including biomethanol.

- Asia: China, Japan, and South Korea are investing heavily in alternative fuels to meet their own climate goals.

These policies are creating a favorable environment for biomethanol, making it a key component of national and regional energy strategies.

2. Corporate Net-Zero Commitments

Major corporations are setting ambitious net-zero targets, and many are turning to biomethanol as a way to decarbonize their operations and supply chains. For example:

- Shipping Giants: Companies like Maersk and Stena Line are investing in methanol-fueled ships to meet International Maritime Organization (IMO) emissions targets.

- Automotive Manufacturers: Automakers are exploring methanol as a bridge fuel for internal combustion engines and as a hydrogen carrier for fuel cell vehicles.

- Chemical Producers: Industry leaders are incorporating biomethanol into their processes to reduce the carbon footprint of plastics, resins, and other products.

3. Technological Innovation

Advances in production technologies are making biomethanol more cost-competitive and scalable. Key innovations include:

- Improved gasification and fermentation processes

- Integration of carbon capture and utilization (CCU)

- Hybrid plants that combine multiple feedstocks

These breakthroughs are lowering production costs, increasing yields, and opening up new markets for biomethanol.

4. Energy Security and Diversification

The volatility of global energy markets and geopolitical tensions have underscored the need for diversified, domestic energy sources. Biomethanol can be produced locally from a variety of feedstocks, reducing reliance on imported oil and gas.

5. Investor Appetite for ESG Assets

Environmental, Social, and Governance (ESG) investing is no longer a niche strategy—it’s mainstream. Institutional investors, pension funds, and sovereign wealth funds are seeking assets that align with sustainability goals and offer long-term value. Biomethanol projects tick all the boxes:

- Strong environmental benefits

- Alignment with regulatory trends

- Potential for stable, long-term returns

Who’s Investing in Biomethanol?

The list of investors pouring money into biomethanol is both broad and impressive:

1. Energy Majors

Oil and gas giants like Shell, BP, and TotalEnergies are investing in biomethanol as part of their broader shift toward renewables. These companies bring deep pockets, technical expertise, and global reach—accelerating the scaling of biomethanol projects.

2. Shipping and Logistics Companies

The maritime sector is a major driver of biomethanol demand. Companies like Maersk, MSC, and CMA CGM are investing in methanol-powered vessels and fueling infrastructure, betting that biomethanol will be a key fuel for the future of shipping.

3. Chemical and Industrial Firms

Leading chemical producers such as BASF, SABIC, and Dow are incorporating biomethanol into their supply chains to meet customer demand for greener products.

4. Private Equity and Venture Capital

A new wave of private equity and venture capital funds are targeting biomethanol startups and scale-ups, attracted by the sector’s growth potential and alignment with ESG criteria.

5. Government and Multilateral Agencies

Public investment is also playing a crucial role, with governments and development banks providing grants, loans, and guarantees to de-risk biomethanol projects and catalyze private capital.

Real-World Examples: Biomethanol Projects Making Headlines

1. Maersk’s Methanol-Powered Fleet

Shipping giant Maersk has ordered a series of methanol-powered container ships and is investing in biomethanol production facilities in Europe and Asia. The company aims to operate an entirely carbon-neutral fleet by 2040, with biomethanol as a cornerstone of its fuel strategy.

2. European Biomethanol Plants

Several large-scale biomethanol plants are under construction in the Netherlands, Denmark, and Sweden, leveraging local agricultural and forestry waste to produce low-carbon methanol for transportation and industry.

3. North American Expansion

In the United States and Canada, startups and established energy companies are building biomethanol plants using municipal solid waste and renewable electricity, supported by federal and state incentives.

4. China’s Methanol Economy

China is rapidly scaling up methanol production and consumption, with a growing share coming from renewable sources. The country’s “methanol economy” strategy is positioning biomethanol as a key fuel for transportation and industry.

Challenges and Risks: What Investors Need to Know

While the outlook for biomethanol is bright, there are challenges to be aware of:

1. Feedstock Availability and Cost

Scaling up biomethanol production requires a reliable supply of affordable biomass or waste feedstocks. Competition with other biofuels and industries can drive up prices and limit availability.

2. Policy and Regulatory Uncertainty

While policy support is strong in many regions, changes in government priorities or subsidy structures could impact project economics.

3. Technology and Scale-Up Risks

Many biomethanol technologies are still being commercialized. Investors must carefully assess technical risks and the ability of projects to scale efficiently.

4. Market Acceptance

Widespread adoption of biomethanol in transportation and industry will require continued investment in infrastructure, standards, and consumer education.

The Future of Biomethanol: A Game-Changer for Clean Energy

Despite these challenges, the momentum behind biomethanol is undeniable. Here’s why the future looks so promising:

1. Integration With Other Clean Technologies

Biomethanol can play a synergistic role alongside other renewables. For example, power-to-methanol plants can help balance the grid by converting excess wind or solar power into storable, transportable fuel.

2. Role in the Hydrogen Economy

Methanol is an efficient hydrogen carrier, making it a valuable asset in the emerging hydrogen economy. Biomethanol can be reformed into hydrogen at the point of use, supporting fuel cell vehicles and industrial processes.

3. Circular Economy and Waste Valorization

By turning waste into fuel, biomethanol supports a circular economy and helps solve pressing waste management challenges.

4. Global Scalability

With diverse feedstocks and flexible production methods, biomethanol can be produced in regions around the world, supporting local economies and energy security.

Conclusion: Biomethanol Is the Next Big Thing in Clean Energy Investment

The quiet surge of investment into biomethanol is no accident. As the world seeks practical, scalable solutions to the climate crisis, biomethanol stands out for its versatility, sustainability, and economic potential. Major investors—from oil majors and shipping companies to private equity and governments—are betting that biomethanol will be a cornerstone of the clean energy transition.

For those looking to ride the next wave of sustainable energy, biomethanol offers a rare combination of environmental impact, market growth, and investment opportunity. As more projects come online and technology advances, expect biomethanol to move from the shadows to center stage in the global energy conversation.

In summary: Major investors are quietly pouring billions into biomethanol because it offers a powerful blend of climate benefits, market potential, and strategic value. Whether you’re an investor, policymaker, or industry leader, now is the time to pay attention to biomethanol—the renewable fuel that’s poised to change the world.

Stay Updated on Renewable Energy Trends

Subscribe to our newsletter for the latest insights on clean energy investments and sustainable technologies.

Subscribe NowShare & Promote This Blog

Explore strategic platforms to link back and amplify this blog’s reach:

1. Industry Publications & Guest Posts

- Renewable Energy World – Submit a guest piece on biomethanol trends.

- Biofuels Digest – Pitch a summary or unique angle from this blog.

- Green Car Congress – Share insights on transport decarbonization.

2. Academic & Research Platforms

- ResearchGate – Join research discussions and link to your blog.

- Academia.edu – Upload a white paper version with blog link.

3. Q&A and Knowledge Sharing Sites

- Quora – Answer questions related to biomethanol and link your blog.

- Reddit – Share your blog in discussions across relevant subreddits.

4. Business & Investment News

- Investing.com – Submit investment analysis with backlink.

- Seeking Alpha – Contribute articles on biomethanol’s potential.

5. Environmental & Sustainability Blogs

- Treehugger – Suggest this blog as an alternative fuel resource.

- EcoWatch – Pitch a guest post or comment with a link.

6. Industry Associations & Directories

- Methanol Institute – Request to be listed or contribute.

- Bioenergy Insight Magazine – Submit your blog as news or analysis.

7. Press Release Distribution

- PR Newswire – Share key insights from this blog.

- Business Wire – Announce your blog’s findings widely.

8. Social Media & Professional Networks

- LinkedIn Articles – Post highlights and link back.

- Medium – Republish or link a summary version.

9. Relevant Forums

- Energy Central – Share in energy-focused groups.

- CleanTechnica – Join forum discussions and comment sections.

Clean Shipping’s Secret Weapons

Explore how biomethanol is transforming the maritime industry as a clean alternative fuel.

Read MoreTurning Landfill Liabilities into Liquid Gold

Discover how landfill waste is converted into valuable biomethanol fuel using circular economy technologies.

Read More