How Public-Private Partnerships Fund Advanced Biofuel Technology

The global energy landscape is undergoing a monumental shift, driven by an urgent need to decarbonize and transition away from fossil fuels. At the forefront of this revolution are advanced biofuels – a sustainable alternative with the potential to power our future without the heavy environmental footprint. However, developing these cutting-edge technologies from lab-scale to commercial viability requires substantial investment, often beyond the reach of a single entity. This is where Public-Private Partnerships (PPPs) step in, forming the backbone of innovation and deployment in the advanced biofuel sector.

PPPs in advanced biofuels are intricate financial ecosystems, leveraging a strategic mix of public grants, co-funding for pilot and demonstration plants, crucial tax incentives, and direct investment from private entities. This synergistic approach not only de-risks nascent technologies but also accelerates their journey to market. But how exactly do these partnerships work to channel vital funds into this critical green technology? Let’s explore the multifaceted funding mechanisms and policy frameworks that underpin advanced biofuel innovation.

The Foundation: Understanding Public-Private Partnerships in Biofuels

Before delving into the funding specifics, it’s essential to grasp the core concept of a PPP within the advanced biofuel context. A Public-Private Partnership is a collaborative arrangement between a government entity (local, regional, or national) and one or more private sector companies El-Araby, R. (2024). The goal is to leverage the strengths of both the public sector’s ability to provide foundational support, policy frameworks, and initial de-risking capital, and the private sector’s innovation, efficiency, market expertise, and commercialization drive.

In advanced biofuels, these partnerships are particularly vital because:

- High R&D Costs: Developing new biofuel conversion pathways from biomass requires intensive research and development, which is capital-intensive and time-consuming.

- Technological Risk: Many advanced biofuel technologies are still maturing, carrying inherent technological and scale-up risks that deter purely private investment in early stages.

- Infrastructure Requirements: Establishing biorefineries and supply chains demands significant upfront capital for infrastructure.

- Market Uncertainty: Policy stability and market demand signals are crucial for private investors, which governments can help provide.

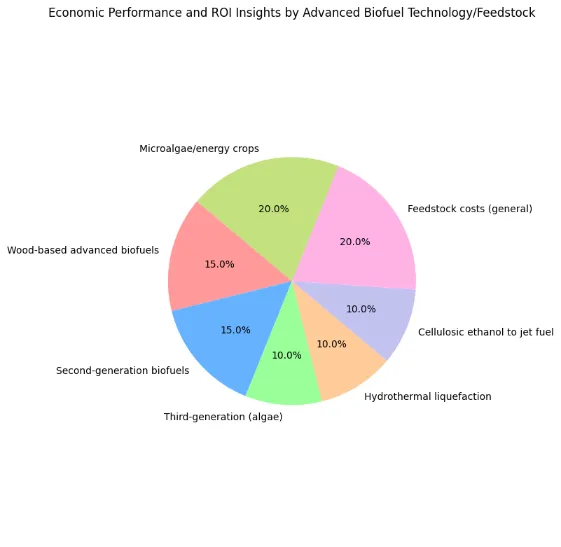

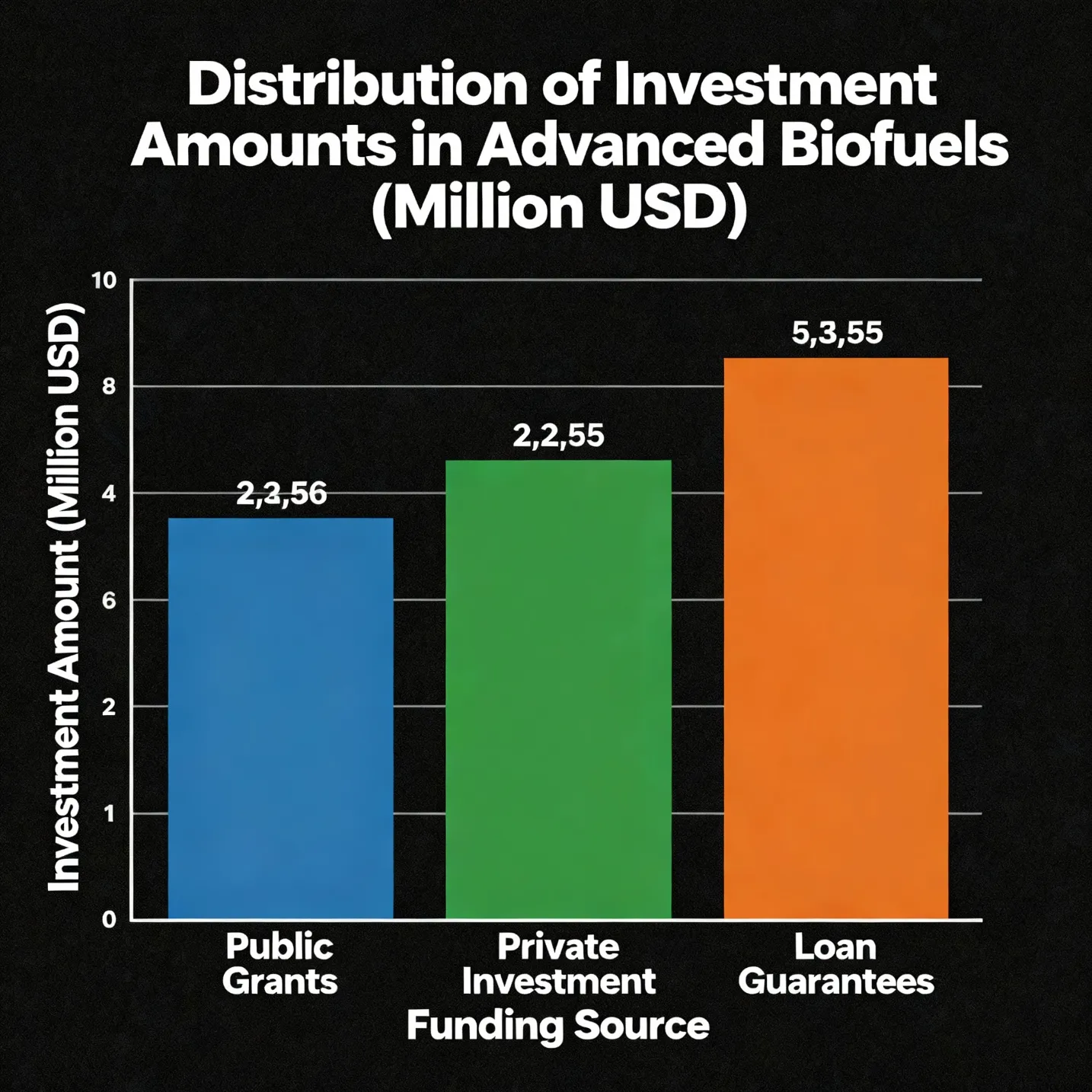

- following is the graphical representation of the above context

The blend of public and private funding creates a robust financial architecture that addresses these challenges, paving the way for sustainable energy solutions.

The Public Sector’s Role: De-risking and Incentivizing Investment

Governments worldwide recognize the strategic importance of advanced biofuels for energy security, climate change mitigation, and economic development. Consequently, they play a proactive role in nurturing this industry, primarily by mitigating financial risks and creating an attractive investment climate.

1. Public Grants and Research Funding

A significant portion of public funding comes in the form of grants for research and development (R&D) Palage, et,al. (2019). These grants are often awarded to universities, national laboratories, and private companies undertaking foundational or applied research in areas such as:

- Novel biomass feedstocks (e.g., algae, switchgrass, municipal solid waste)

- Advanced conversion technologies (e.g., biochemical, thermochemical, catalytic processes)

- Biofuel upgrading and purification

- Life cycle assessment and sustainability studies

These grants are critical “technology-push” policies. By funding early stage research, governments help derisk concepts and gather crucial data, making them more appealing for later-stage private investment. For example, many of the breakthroughs in cellulosic ethanol or hydrotreated vegetable oil (HVO) started with public grants supporting initial scientific exploration.

2. Co-funding for Pilot and Demonstration Plants

Perhaps one of the most impactful public contributions is the co-funding of pilot and demonstration plants. This is a crucial transitional phase between laboratory success and full commercialization. Pilot plants test the technology at a smaller, integrated scale, while demonstration plants operate at a pre-commercial scale to prove technical and economic viability.

Public co-funding in this area is a powerful innovation booster. Studies have consistently shown that public co funding of pilot and demonstration plants has a direct correlation with increased patenting activity in advanced biofuels. This indicates that government support at this critical juncture accelerates the maturation of technologies and encourages companies to invest further in intellectual property.

Imagine a breakthrough enzyme for breaking down lignin in biomass. A public grant might fund the initial lab research. But to prove it works continuously and efficiently, a pilot plant is needed. Public co funding helps bridge the “valley of death” the gap where early stage research has shown promise but hasn’t yet attracted sufficient private capital for larger-scale validation. This shared investment reduces the financial burden and risk for private partners, encouraging them to commit resources to scaling up.

3. Tax Incentives

Governments provide substantial financial incentives through the tax system to make advanced biofuel production more economically viable and attractive. These incentives primarily aim to offset the higher production costs compared to fossil fuels or conventional biofuels. Key tax incentives include:

- Tax Credits: These directly reduce a company’s tax liability. Examples include production tax credits for each gallon of advanced biofuel produced, or investment tax credits for capital expenditures on biofuel production facilities.

- Accelerated Depreciation: Allows companies to deduct the cost of their assets more quickly, reducing taxable income in earlier years and improving cash flow.

- Research and Development (R&D) Tax Credits: Encourages private companies to invest in R&D by reducing the cost of their innovation activities.

These tax incentives act as a consistent financial stimulus, improving the internal rate of return (IRR) for advanced biofuel projects and making them more competitive against established fossil fuel industries.

4. Loan Guarantees and Direct Loans

Another vital public mechanism is the provision of loan guarantees and direct loans. High upfront capital requirements and perceived risks can make it challenging for advanced biofuel projects to secure conventional financing from private lenders.

- Loan Guarantees: A government agency guarantees a portion of a loan provided by a private bank. If the project defaults, the government covers the guaranteed amount. This reduces risk for the private lender, making them more willing to lend at more favorable terms.

- Direct Loans: In some cases, government agencies provide direct loans, often at lower interest rates or with more flexible repayment terms than commercial banks.

These mechanisms are particularly useful for large scale infrastructure projects like biorefineries, which require hundreds of millions or even billions of dollars in capital. They help bridge the financing gap that often exists for first-of-a-kind commercial facilities.

The Private Sector’s Contribution: Innovation and Commercialization

While public funding provides the initial impetus and de-risking, the private sector is the engine of innovation, efficiency, and ultimately, commercialization. Private entities bring entrepreneurial drive, technological expertise, market acumen, and crucial capital for scaling up.

1. Direct Equity Investment

Private companies, venture capitalists, private equity firms, and corporate investors provide direct equity investment into advanced biofuel projects and companies. This funding comes in various stages:

- Seed and Early-Stage Funding: Often from angel investors or specialized venture capital funds targeting disruptive technologies.

- Growth Equity: As technologies mature and companies look to expand, private equity and larger venture funds invest to scale operations.

- Corporate Venturing: Large energy companies, chemical companies, or even automotive manufacturers invest in advanced biofuel startups to secure future feedstock, develop new products, or gain a foothold in emerging markets.

These private investments are driven by the potential for significant returns, market leadership, and the strategic importance of sustainable solutions.

2. Project Financing

For large-scale commercial biorefineries, project financing is a common approach. This involves structuring a debt and equity package specifically for a single project, where the debt is repaid from the project’s future cash flows. Private banks, institutional investors, and sometimes multilateral development banks (e.g., World Bank, IFC) participate in project finance deals.

The feasibility of securing project finance for advanced biofuels is significantly enhanced by the public sector’s role in de-risking the technology and providing demand-side assurances. A project with robust off-take agreements (contracts to sell the biofuel), guaranteed loan portions, and proven technology (thanks to pilot and demo plant co-funding) is much more attractive to private lenders.

3. Corporate Partnerships and Joint Ventures

Private companies also form partnerships with each other or with public research institutions to share risks, combine expertise, and pool resources. These joint ventures are common for:

- Developing specific components of the biofuel value chain (e.g., feedstock aggregation, processing, distribution).

- Licensing technology developed by a research institution to commercialize it.

- Building and operating large-scale production facilities.

These collaborations leverage complementary strengths – one company might have expertise in biomass supply, another in conversion technology, and a third in fuel distribution.

The Synergistic Dance: Technology Push and Demand Pull Policies

The success of PPPs in advanced biofuels hinges on a balanced combination of “technology-push” and “demand-pull” policies.

Technology-Push Policies are designed to stimulate innovation and bring new technologies to market readiness. These primarily include:

- R&D Funding: Grants for basic and applied research.

- Pilot and Demonstration Plant Co-funding: Financial support for scaling up and validating technologies.

- Early-Stage Investment: Tax incentives for R&D.

These policies are crucial for overcoming the technical barriers and high initial costs associated with nascent technologies. They push the boundaries of what’s scientifically and technically possible.

Public-private partnerships (PPPs) are crucial for accelerating advanced biofuel innovation by strategically blending public and private funding. This model leverages public grants and co-funding for pilot and demonstration plants, effectively de-risking high-cost, nascent technologies. For example, in 2025, companies like LanzaJet and Nova Pangaea Technologies received significant government funding from initiatives like the UK’s Advanced Fuels Fund (AFF), a clear sign of public co-investment to prove and scale their technologies. This initial public support acts as a catalyst, attracting crucial private capital from investors and corporate partners such as Shell and British Airways, who then fund the commercial-scale deployment. By providing a mix of technology-push (R&D funding) and demand-pull (tax incentives, mandates) policies, governments create the stable environment needed for private companies to invest, ultimately transforming waste into sustainable fuels.

Demand-Pull Policies, on the other hand, create a market for advanced biofuels, making commercial production economically attractive. These policies signal consistent future demand, which is vital for private investors making long-term commitments. Key demand-pull mechanisms include:

- Price-Based Incentives: Subsidies or tax credits tied to the production or sale of advanced biofuels (e.g., Renewable Fuel Standard (RFS) credits in the US, similar schemes in Europe).

- Blending Mandates: Government regulations requiring a certain percentage of advanced biofuels to be blended into conventional fuels. This creates a guaranteed market and steady demand.

- Low Carbon Fuel Standards (LCFS): Policies that assign a carbon intensity score to fuels, rewarding those with lower emissions (like advanced biofuels) and penalizing higher-emission fuels. This creates a value for the carbon reduction achieved by advanced biofuels.

Advanced biofuels, in particular, benefit immensely from a comprehensive combination of these approaches. Technology-push policies nurture the innovation pipeline, ensuring a steady stream of viable technologies. Demand-pull policies then provide the market certainty and revenue streams necessary for these technologies to be deployed at scale. Without demand-pull, even the most innovative biofuel technology might struggle to find a commercial footing. Without technology-push, there might not be sufficient innovative solutions to meet market demand.

Here’s an illustrative example:

Imagine a new process for converting municipal solid waste into jet fuel.

Technology-Push: A government grant funds university research into the catalytic conversion process. Another public co-funding initiative helps a startup build and operate a pilot plant to prove the technology.

Private Investment: Seeing the promising results from the pilot plant, a venture capital firm invests growth equity to help the startup build a larger demonstration plant.

Demand-Pull: Simultaneously, a government introduces a “Sustainable Aviation Fuel (SAF) mandate” requiring airlines to use a certain percentage of SAF by a specific date. This creates a guaranteed market for the advanced jet fuel.

Further Private Investment & PPP: With the market signal clear and technology de-risked, private banks and institutional investors provide project financing for a full-scale commercial biorefinery, potentially backed by government loan guarantees.

This integrated approach exemplifies the power of PPPs.

Challenges and the Future of PPPs in Advanced Biofuels

While PPPs are crucial, they are not without challenges. These can include:

- Policy Instability: Frequent changes in government energy policy or incentive programs can create uncertainty for long-term private investments.

- Bureaucracy: Navigating complex government grant applications and regulatory processes can be time-consuming for private entities.

- Coordination Issues: Ensuring seamless collaboration between public and private partners, each with different objectives and timelines, requires strong governance.

Despite these hurdles, the imperative to develop sustainable energy sources ensures that PPPs will continue to be a cornerstone of advanced biofuel development. The future will likely see:

- Increased Focus on Novel Feedstocks: Partnerships will explore and fund technologies for converting a wider range of non-food feedstocks, including agricultural residues, forestry waste, and CO2.

- Integration with Other Green Technologies: Advanced biofuels could be integrated with carbon capture and utilization (CCU) or green hydrogen production, creating synergistic value chains.

- International Collaboration: Cross-border PPPs could emerge to address global energy challenges and facilitate technology transfer.

The role of PPPs is not just about funding; it’s about fostering an ecosystem of innovation. They build confidence, share knowledge, and create the necessary infrastructure and market conditions for advanced biofuels to truly flourish.

Conclusion

The journey from a laboratory breakthrough to a commercial-scale advanced biorefinery is long, complex, and capital-intensive. It is a journey that few private companies can undertake alone and one that is too critical for governments to ignore. Public-Private Partnerships are the essential mechanism that bridges this gap, combining strategic public support with private sector ingenuity.

By providing crucial public grants, co-funding pilot and demonstration plants, offering significant tax incentives, and implementing robust loan guarantees, governments effectively de-risk advanced biofuel technologies. This public foundation then attracts vital private capital through direct equity investments, project financing, and strategic corporate partnerships.

The interplay of technology-push and demand-pull policies further solidifies this framework, ensuring that both innovation is fostered and a viable market is created. As the world pushes towards a greener future, these collaborative funding models will remain indispensable, accelerating the development and deployment of advanced biofuel technology, and ultimately, powering a more sustainable planet.

Citations

El-Araby, R. (2024). Biofuel production: exploring renewable energy solutions for a greener future. Biotechnology for Biofuels and Bioproducts, 17. https://doi.org/10.1186/s13068-024-02571-9.

Palage, K., Lundmark, R., & Söderholm, P. (2019). The impact of pilot and demonstration plants on innovation: The case of advanced biofuel patenting in the European Union. International Journal of Production Economics. https://doi.org/10.1016/J.IJPE.2019.01.002.

Building Investor Confidence — De-risking Capital Investment in Advanced Biofuel Value Chains