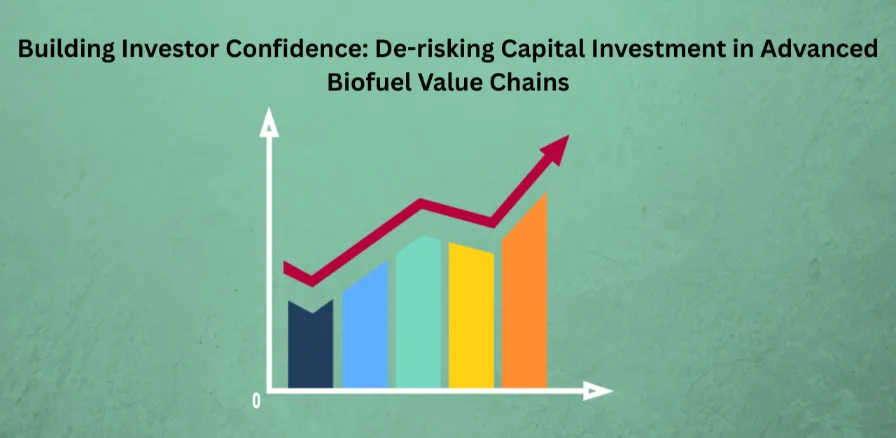

De-risking Capital Investment: Building Investor Confidence in Advanced Biofuel Value Chains

The global push for decarbonization has put advanced biofuels in the spotlight as a crucial tool for a sustainable energy future. These next-generation fuels, derived from non food feedstocks like agricultural waste, algae, and forestry residues, offer a compelling alternative to fossil fuels. They don’t compete with food crops and have a significantly smaller carbon footprint, making them a more sustainable choice. However, despite their immense potential, the advanced biofuel sector has struggled to attract the scale of investment needed for widespread commercialization. Why? The simple answer is risk.

Investors, from private equity firms to venture capitalists, are wary of the technological and market uncertainties inherent in this nascent industry. They see a high risk, high capital landscape with unproven technologies and unpredictable policy environments. To unlock the trillions of dollars of capital required to build a robust advanced biofuel economy, we must systematically de risk the entire value chain. This isn’t just about building a plant; it’s about creating an ecosystem of confidence that benefits global markets and delivers a strong return on investment (ROI).

The Core Challenges: Understanding the Investor Mindset

Before we can build confidence, we must understand the sources of investor skepticism. The advanced biofuel value chain is complex, encompassing everything from feedstock sourcing to final fuel distribution. Each stage presents unique risks.

- Technology Risk: Many advanced biofuel technologies are still in the demonstration or pilot phase. Investors fear that a promising lab scale process may not be economically viable or scalable for commercial production. There’s a concern about performance, reliability, and the potential for a “valley of death” where a technology fails to bridge the gap from R&D to commercial viability.

- Feedstock Risk: A consistent and affordable supply of sustainable feedstock is the lifeblood of an advanced biofuel facility. Sourcing agricultural waste, municipal solid waste, or purpose grown energy crops at scale can be challenging due to seasonal variations, competition from other industries, and inconsistent quality. This creates significant supply chain volatility that directly impacts project economics.

- Market Risk: The price of advanced biofuels is often tied to the volatile price of fossil fuels. Without robust, long-term policy support, a sudden drop in crude oil prices can make a biofuel project unprofitable overnight. Furthermore, the market for products like Sustainable Aviation Fuel (SAF) is still developing, and demand can be unpredictable.

- Policy and Regulatory Risk: This is perhaps the most significant barrier. Government policies, such as blending mandates, tax credits, and carbon pricing mechanisms, are critical for making advanced biofuels competitive. However, frequent changes or a lack of long term policy stability can spook investors. They need a predictable regulatory environment to justify large, multi-decade investments.

De-risking the Value Chain: Strategies for Success

Building investor confidence is a multi faceted endeavor that requires collaboration between technology developers, governments, and financial institutions. By addressing each risk category head-on, we can transform the perception of the advanced biofuel sector from a high-risk gamble to a strategic, profitable investment.

1. Mitigating Technology and Execution Risk

The “valley of death” can be bridged with a combination of robust R&D and strategic partnerships.

- Pilot and Demonstration Plants: Public private partnerships and government grants for pilot and demonstration facilities are crucial. These projects prove the technology at a larger scale, validate the process economics, and provide crucial operational data. This data is the gold standard for attracting private capital for full scale commercial plants.

- Integrated Biorefineries: The future of advanced biofuels isn’t just about producing fuel. It’s about creating integrated biorefineries that produce a range of co products, such as bioplastics, chemicals, and power. This diversification of revenue streams insulates the project from fuel price volatility and enhances profitability, making it a more attractive investment.

- Technological Standardization: As certain conversion technologies mature, developing industry wide standards for production processes and fuel specifications can lower perceived risk. This allows for easier due diligence and comparison for investors.

2. Stabilizing the Supply Chain and Feedstock Sourcing

Securing a consistent and cost effective feedstock supply is fundamental to project success.

- Long-Term Offtake Agreements: Project developers must secure long term, multi year contracts with feedstock suppliers. These agreements, often with fixed or predictable pricing mechanisms, provide a stable foundation for the business model.

- Diversified Feedstock Portfolio: Relying on a single feedstock is a significant risk. Companies that can process a variety of feedstocks—from agricultural residues to municipal waste are more resilient to supply disruptions and price fluctuations.

- Digital Supply Chain Management: Leveraging technology to track feedstock availability, quality, and logistics can optimize the supply chain and reduce operational uncertainty. Blockchain and other digital tools can be used to ensure the sustainability and origin of the feedstock, adding a layer of trust.

3. Building a Resilient Market and Financial Framework

Creating a robust market for advanced biofuels is paramount to driving investment.

- Carbon Pricing Mechanisms: Implementing a clear and stable price on carbon, either through a carbon tax or an emissions trading system, is one of the most effective ways to make advanced biofuels economically competitive. When polluters have to pay for their emissions, the value of a low-carbon fuel increases.

- Blending Mandates and Credits: Long-term, binding blending mandates (like the U.S. Renewable Fuel Standard or EU’s Renewable Energy Directive) provide a guaranteed market for advanced biofuels. Credit markets, such as the market for Renewable Identification Numbers (RINs) or credits under the Clean Fuel Standard, provide a financial incentive that can be factored into a project’s ROI calculation.

- Public-Private Financial Instruments: Governments can use a variety of financial tools to lower risk for private investors. This includes loan guarantees, tax credits for capital investment, and direct grants for project development. These instruments don’t just provide capital; they signal strong government commitment to the industry, which is a powerful confidence builder.

The ROI Equation: A Profitable and Purpose Driven Investment

Investing in advanced biofuels isn’t just a feel good choice; it’s a smart business decision with a compelling ROI. While individual project returns can vary widely based on technology, location, and market conditions, a strategic approach can yield significant financial benefits.

- Potential for High ROI: While traditional first generation biofuel projects might see an ROI in the mid-single digits, advanced biofuel projects, when de risked and optimized, can generate significantly higher returns. With a stable policy environment and efficient operations, a project can potentially achieve an ROI of 15% to 25% or even higher. This is driven by several factors:

- Higher Margins: Advanced biofuels often command a price premium due to their lower carbon intensity and the high demand in hard-to-abate sectors like aviation (SAF).

- Co-product Revenue: As mentioned, the sale of high value co-products like bioplastics or renewable chemicals can create additional revenue streams that boost overall profitability.

- Carbon Credit Monetization: The ability to generate and sell carbon credits provides a valuable, non-volatile revenue source that enhances the project’s financial stability.

- Global Market Benefits: Beyond the individual project ROI, de-risking advanced biofuel value chains has massive benefits for the global economy.

- Energy Security: It reduces reliance on volatile fossil fuel markets and strengthens domestic energy independence.

- Rural Economic Development: Biofuel facilities create jobs in rural and agricultural communities, from feedstock harvesting and transportation to plant operations.

- Environmental Impact: It directly contributes to global climate goals by reducing greenhouse gas emissions in the transportation sector, a major source of carbon.

Conclusion: A New Era of Sustainable Investment

The advanced biofuel industry is on the cusp of a major transformation. The challenges of high capital costs and technological uncertainty are real, but they are not insurmountable. By embracing a holistic strategy of de-risking the entire value chain through a combination of technological maturity, stable supply chains, and robust policy frameworks we can unlock the immense potential of this sector.

For investors, this new era presents a unique opportunity to align their portfolios with the global transition to a sustainable economy. By supporting projects that not only promise a solid ROI but also contribute to a cleaner, more secure energy future, we are not just making a wise financial decision; we are helping to build the world of tomorrow. The time to invest is now, as the seeds of a new, profitable, and purpose driven energy landscape are ready to grow.

Building Investor Confidence: De-Risking Capital Investment in Advanced Biofuel Value Chains