India Methanol Economy: Opportunities and Challenges for Biomethanol from Biogas

India is the third largest energy consumer in the world. It faces two big challenges: energy security and reducing carbon emissions. The country wants to lower its substantial oil import bill and meet its goal of net-zero emissions by 2070. This has led to innovative strategies. One key approach is the ‘Methanol Economy.’ Led by NITI Aayog, the nationwide effort aims to replace traditional fossil fuels with locally sourced methanol, especially biomethanol made from biogas. This shift represents a transformative solution that turns waste into valuable resources, offering significant environmental and social advantages.

This blog looks at India’s growing biomethanol sector, its potential, the policy landscape, and the challenges to widespread adoption.

India’s Methanol Economy: National Vision and Strategic Imperatives

NITI Aayog’s Methanol Economy Program

NITI Aayog launched the ‘Methanol Economy’ program in 2016. This initiative aims to change India’s energy landscape. The program supports national goals to:

- Guide India towards a low-carbon and carbon-neutral future.

- Significantly reduce the country’s oil import bill: blending 15% methanol (M15) with gasoline could cut crude oil imports by at least 15% and reduce national fuel costs by 30%.

- Lower greenhouse gas emissions: blending methanol in fuels could cut particulate matter, NOx, and SOx by about 20%, with even greater reductions when using biomethanol from renewable sources.

- Create jobs: methanol production, distribution, and use can generate up to 5 million jobs.

- Turn waste into resources: convert abundant waste streams like high ash coal, agricultural residue, and municipal waste into valuable methanol, addressing waste management and sustainability.

Market Status and Demand Growth

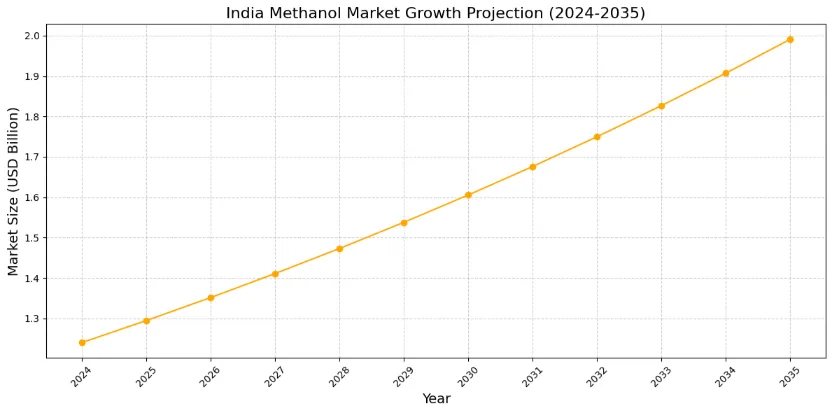

India has an installed methanol capacity of 2 million tonnes per year (MTPA). However, it imports over 90% of its demand of 1.8 MTPA, a number expected to keep rising. The Indian methanol market was valued between $1.24 and $1.63 billion in 2024 and could reach $2.75 billion by 2035, growing at a steady annual rate of 4.4-4.9%.

To reduce dependency on imports and stabilize prices, India is investing in new domestic capacity:

- Five methanol plants based on high-ash coal.

- Five dimethyl ether (DME) plants.

- One natural gas-based methanol facility (20 MMT/year) in collaboration with Israel.

The focus on self-sufficiency, known as Atmanirbhar Bharat, is driving policies and investment to shift from imports to locally sourced, including renewable, methanol.

Diverse Applications and Market Potential

Methanol’s flexibility makes it vital in India’s changing energy landscape:

- Transport: it serves as a direct replacement for petrol and diesel (in road, rail, marine). Blends like M-15, M-85, and M-100 have been approved, with pilot programs starting in partnership with Indian Oil and others.

- Power and Industry: used in diesel generators, boilers, tractors, and commercial vehicles. Indian manufacturers are testing DMFC (Direct Methanol Fuel Cell) applications in areas like telecom.

- Cooking Fuel: methanol stoves, successfully demonstrated in Assam, provide cleaner, more affordable options for households, reducing annual cooking fuel expenses by 20%.

- Feedstock: as a basic chemical, methanol helps produce formaldehyde, acetic acid, plastics, paints, and more.

Methanol also works as an efficient hydrogen carrier. It can be easily integrated with existing logistics and storage systems, making it a key link to a future hydrogen economy.

Why Biomethanol from Biogas

Environmental Advantages

Deep Decarbonization: Biomethanol sourced from biogas can cut CO2 emissions by up to 95% and NOx by up to 80% compared to fossil methanol.

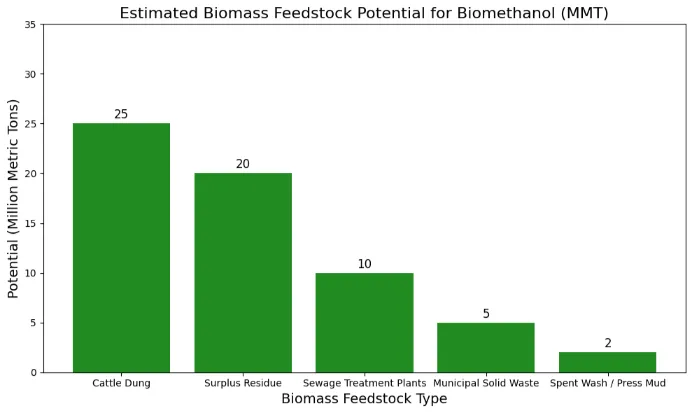

Waste Management: India produces over 105 billion tonnes of organic waste each year, but only about 2% gets recycled. Biogas plants utilize agricultural waste, dung, municipal waste, and sewage to turn environmental liabilities into energy assets.

Air Quality: Methanol blends (M15) can lower urban air pollution by up to 40%. Cooking with methanol reduces household air pollution, providing major health benefits, particularly for women.

The process also produces nutrient-rich digestate, decreasing reliance on chemical fertilizers and supporting a strong circular economy.

Economic and Rural Impact

Energy Security: Biomethanol, produced domestically and renewably, reduces dependence on imported fuels and mitigates risks from volatile global markets.

Cost Savings: Production costs for methanol range from Rs 16-21 per litre (renewable/fossil), making it at least 30% cheaper than petrol or diesel.

Rural Development: Farmers earn additional income selling agricultural waste, and local jobs are created across the supply chain from collecting waste to operating plants.

Municipal Resilience: Waste-to-methanol plants lower municipal waste management costs and generate revenue.

Policy and Regulatory Momentum

The Indian government has laid a strong policy foundation for biomethanol through various initiatives:

- National Biofuel Policy (2018, amended 2022): aims for 20% ethanol (petrol) and 5% biodiesel (diesel) blending by 2030; supports waste-based refineries.

- GOBARdhan Scheme: turns rural organic waste into biogas/CBG and organic fertilizer, promoting rural entrepreneurship.

- SATAT Program: plans to set up 5,000 CBG plants by 2024; mandates 1% CBG blending starting in 2025, increasing to 5% by 2028.

- Methanol Economy Fund: INR 4,000-5,000 crore set aside for encouraging methanol adoption and capacity growth.

- Green Hydrogen Mission: offers $2.3 billion in subsidies, including incentives for green methanol.

- State-Level Support: provides additional capital subsidies, tax breaks, and favorable land terms for bioenergy in key states like UP, Gujarat, and MP.

Incentives and Mandates

Capital subsidies (up to 35% for green hydrogen, 30% for biofuels)

Excise/custom waivers, carbon credits, low-interest loans

Direct blending mandates for CBG, DME/LPG, and methanol in fuels

Guaranteed purchase agreements for CBG/methanol producers by oil marketing companies

Despite these initiatives, progress is slow due to regulatory delays, infrastructure challenges, and inconsistent policy execution.

Advances in Technology and Demonstration Projects

There is significant R&D and demonstration activity underway:

- Thermochemical Conversion: biomass is turned into gas, then into methanol. This method is already effective for coal, but is now being adapted for biogenic feedstock.

- Biochemical Conversion: organic waste first produces biogas, which is then converted to methanol. This method accommodates various waste streams and is a leading option for rural bio-refineries.

- Indigenous Innovation: IISc Bangalore and Praj Industries have successfully produced syngas from biomass. BHEL Hyderabad and IIT Delhi are advancing coal-to-methanol pilot projects.

- International Collaborations: Topsoe’s eSMR Methanol™ (CO2-neutral, biogas-based), NTPC-Tecnimont for commercial green methanol, and major Indian companies like Adani and Reliance are investing in biogas and biomethanol projects.

Pilot municipal projects, such as the one in Gurugram (processing 500 tonnes of waste daily into 50 kiloliters of methanol), demonstrate scalability and local value creation.

Major Challenges for Scaling Biomethanol from Biogas

1. Economic Viability

Cost Disparity: Fossil methanol prices range from $100–250/metric ton, while biomethanol costs $770/metric ton, making price parity a significant challenge for policy.

Energy Content: Methanol has a lower calorific value (22 MJ/kg compared to 45-46 MJ/kg for petrol/diesel), meaning users need a larger volume for the same energy, despite a lower price per litre.

Investment Gaps: Although subsidies and incentives are improving the situation, investor confidence is affected by the developing market and “green premium.”

2. Feedstock Collection, Logistics, and Supply Chain

Aggregation Problems: Only 5,000–7,000 tonnes of biomass are supplied daily to power plants, while 100,000 tonnes are required.

Seasonality/Volatility: The supply of agricultural residues varies, making pricing unpredictable.

Land Use: It is critical to avoid competing with food and agricultural production, focusing instead on non-food, waste-based sources.

3. Technical Hurdles

Biogas Purification: Removing impurities like H2S, CO2, and NH3 is costly and requires a lot of energy.

Conversion Efficiency: Directly converting methane to methanol is still being optimized; most industrial methods are still two-step and require significant investment.

Scaling Up: While demonstration projects show promise, fully commercial deployment is a work in progress.

4. Infrastructure and Distribution

Centralization vs. Decentralization: Biogas and biomethanol production are decentralized, but distribution tends to be centralized, creating logistical challenges.

Storage and Transport: Although methanol is easier to handle than hydrogen, the infrastructure for biomethanol is still under development nationwide.

Conclusion: The Way Forward

India’s biomethanol strategy using biogas represents a forward-thinking approach to turning waste into wealth, which is critical for the country’s sustainable energy future. While there have been significant advancements in policy, technology, and pilot projects, expanding this strategy will depend on:

- Improving policy consistency and execution.

- Strengthening supply chains and logistics for feedstock.

- Accelerating research and development to lower costs and increase efficiency.

- Providing strong incentives and securing market-based purchase agreements to attract private investment.

- Encouraging technology transfer and local innovation, fostering collaboration among government, academia, and industry.

By fully utilizing its large biomass resources, enhancing rural livelihoods, and delivering clean, lowcarbon fuel, India can become a leader in biomethanol and biogas while serving as a model for circular, resilient energy economies globally.

Biomethanol from Corn Straw in China: A Life Cycle Insight