Fuelling China’s Future: The Green Promise of Biomethanol vs. the Legacy of Coal-Based Methanol

This blog offers a deep dive into the environmental and chemical distinctions between coal-based and biomethanol in China, emphasizing the urgent shift towards greener energy solutions.

Advantage: Reading this blog equips you with crucial insights into sustainable energy trends, highlighting China’s pivotal role in the global transition to cleaner fuels and the innovations driving this change.

China, the world’s largest consumer and producer of methanol, faces a crucial moment in its energy transition. The country has a huge demand for this versatile chemical, which is used in fuels, plastics, and pharmaceuticals. It struggles to balance economic growth with environmental sustainability. For decades, coal-based methanol has supported this industry by using China’s plentiful coal reserves. However, the urgent need for cleaner energy options has drawn attention to biomethanol as a promising, eco-friendly alternative. This blog explores a detailed comparison of these two methanol production methods, looking at their chemical processes, emissions, environmental effects, and the roles of key industry players. It ultimately underscores the urgent need to move toward greener alternatives.

The Methanol Mandate: A Chemical Comparison

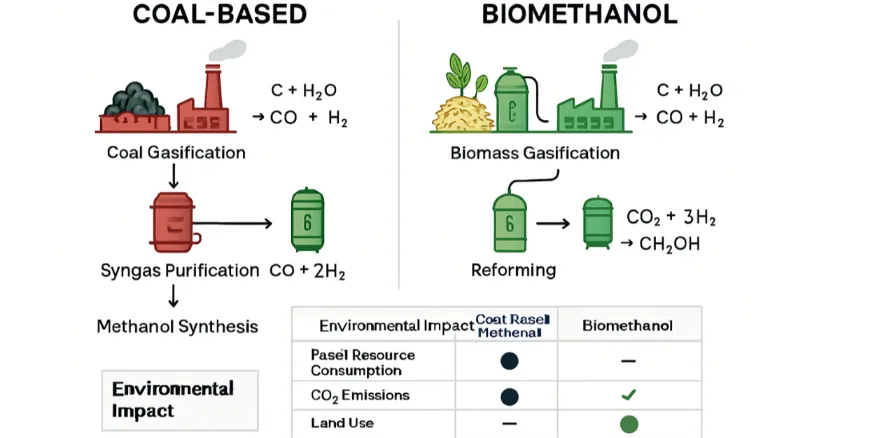

The image provides an overview of the production pathways and environmental impacts of coal-based methanol and biomethanol. It visually contrasts the traditional, carbon-heavy coal gasification route, which produces significant CO₂ emissions and air pollutants from non-renewable coal, with the more sustainable biomethanol processes that use renewable biomass or captured CO₂ along with green hydrogen. The diagram shows each step, from feedstock preparation to methanol synthesis, highlighting how biomethanol results in much lower carbon emissions, reduced air pollutants, and better sustainability. A side-by-side comparison table further underscores the clear differences in carbon intensity, feedstock sources, air pollution, water use, and overall energy balance. This makes the environmental benefits of moving towards biomethanol—and especially green methanol using captured CO₂ and renewable energy—very apparent.

Emissions Data:

- Greenhouse Gas (GHG) Emissions: Coal-to-methanol (CTM) processes are among the most GHG-intensive pathways for methanol production nowadays. Life cycle assessments (LCA) consistently show that CTM has a very high carbon footprint, often exceeding that of traditional fossil fuels like gasoline and diesel. Studies indicate that CTM processes contribute significantly to global warming potential (GWP), with reported figures in the range of hundreds of kg CO2 equivalent per tonne of methanol, often up to three times higher than natural gas-based methanol.

- Air Pollutants: Beyond CO2, coal gasification releases substantial amounts of other harmful air pollutants, including sulfur dioxide (SO2), nitrogen oxides (NOx), particulate matter (PM), and heavy metals. These contribute to acidification, photochemical oxidation, and respiratory diseases.

- Water Consumption: CTM plants are also highly water-intensive, consuming vast quantities of water for cooling, gasification, and other processes, putting strain on water resources in often arid regions of China where these plants are typically located.

- Solid Waste: Coal ash and other solid wastes are byproducts, posing disposal challenges and potential contamination risks.

Biomethanol: A Greener Horizon

Biomethanol offers a significantly lower environmental impact due to its renewable feedstock and potential for carbon neutrality or even negativity.

Emissions Data:

- Greenhouse Gas (GHG) Emissions: The carbon footprint of biomethanol is substantially lower. When produced from sustainable biomass or captured CO2 with green hydrogen, the net CO2 emissions can be reduced by 70-95% compared to fossil-based methanol. The “climate neutrality” of end-use emissions is often highlighted because the carbon released during combustion was originally absorbed by the biomass during its growth. In cases like methanol from manure-based biomethane, it can even have a negative carbon footprint by avoiding methane emissions that would have occurred anyway.

- Air Pollutants: While biomass gasification still produces some pollutants, the overall emissions of SO_x, NO_x, and PM are significantly lower compared to coal, especially with advanced purification technologies. Biomethanol as a fuel drastically cuts NOx (up to 80%), SOx (up to 99%), and particulate matter emissions at the point of use.

- Water Consumption: While still requiring water, the overall life cycle water consumption for biomethanol can be lower, particularly for certain feedstocks and processes, and can often be managed within a circular economy framework.

- Waste Valorization: Utilizing agricultural and municipal waste as feedstock offers the dual benefit of producing energy while mitigating waste accumulation and associated environmental problems like landfill methane emissions.

Environmental Impact Data Comparison (Illustrative, specific values vary by technology and feedstock):

| Impact Category | Coal-Based Methanol (per tonne CH3OH) | Biomethanol (per tonne CH3OH) |

| Global Warming Potential (kgCO2eq) | 500-1000+ (High) | <100 (Potentially negative) |

| Acidification Potential (kgSO2eq) | Moderate to High | Low |

| Eutrophication Potential (kgPO43−eq) | Moderate | Low |

| Human Toxicity Potential | High | Low to Moderate |

| Water Consumption | High | Moderate |

| Solid Waste Generation | High | Low (waste valorization) |

Note: These are illustrative ranges. Actual figures depend heavily on specific plant configurations, energy sources for auxiliary processes, and feedstock origins.

Companies Leading the Charge in China

The landscape of methanol production in China features both entrenched coal-to-methanol giants and emerging players in the biomethanol space.

Companies Utilizing Coal-Based Methanol in China:

China’s coal-based chemical industry is vast, with many large state-owned enterprises and private companies involved. These companies often operate integrated facilities that produce a range of chemicals from coal, with methanol being a key intermediate.

- Yankuang Energy Group Co Ltd. (Yulin Methanol power station): One of the prominent players, their Yulin Methanol power station is a significant coal-to-methanol facility in Shaanxi province. While they contribute to China’s energy security, their operations are rooted in coal.

- URL: While a direct corporate URL for their methanol operations is not readily available, information can be found via their parent company: http://www.yankuanggroup.com/

- Shenhua Group (now part of China Energy Investment Corporation): A massive state-owned energy company, Shenhua has invested heavily in coal-to-chemicals projects, including methanol, throughout China.

- URL: http://www.ceic.com/ (China Energy Investment Corporation)

- Datang Energy Chemical: Another large state-owned enterprise with significant investments in coal-to-chemicals, including methanol production, particularly in Inner Mongolia.

- URL: Information often found through general news and industry reports, a direct specific URL for their methanol operations is not consistently available.

Companies Embracing Biomethanol (Green Methanol) in China:

The green methanol sector is nascent but growing rapidly, driven by environmental mandates and the increasing availability of sustainable feedstocks.

- The Hong Kong and China Gas Company Limited (Towngas): Towngas is a notable pioneer in green methanol. Their methanol production plant in Ordos, Inner Mongolia, utilizes proprietary technology to convert biomass and municipal waste into green methanol, holding ISCC EU and ISCC PLUS certifications. They are actively involved in promoting green methanol as a marine fuel.

- Hyundai Merchant Marine (HMM) & Shanghai International Port Group (SIPG) collaboration: While HMM is a South Korean shipping company, their collaboration with SIPG in Shanghai indicates a growing demand and supply chain for biomethanol in China. SIPG, as a major port operator, facilitates the bunkering of biomethanol. This signifies the adoption of biomethanol as a clean fuel in the maritime sector within China.

- SIPG URL: http://www.portshanghai.com.cn/

- HMM URL: https://www.hmm21.com/

- Shenghong Petrochemical: This company has initiated operations of large-scale CO2-to-methanol plants, demonstrating a commitment to carbon capture and utilization (CCU) for methanol production. While not strictly biomass, utilizing captured CO2 is a key pathway for “green” methanol.

- URL: Specific information might be found within news releases or industry reports, but a direct corporate URL for this specific project is not readily available. Shenghong Petrochemical itself is a large integrated refining and chemical enterprise.

Mitigation Strategies: Paving the Way for a Cleaner Future

Addressing the environmental impact of methanol production, particularly from coal, is paramount for China’s sustainable development. Several mitigation strategies are being explored and implemented.

For Coal-Based Methanol (Transitioning towards lower impact):

- Carbon Capture, Utilization, and Storage (CCUS): This technology aims to capture CO2 emissions from coal-fired plants and either store them underground or utilize them in other industrial processes (e.g., for enhanced oil recovery or even in CO2to-methanol synthesis). This can significantly reduce the carbon footprint, although it adds to the energy consumption and cost.

- Relevant research and development is ongoing in China, with many universities and research institutes collaborating with industrial players.

- Example: China National Petroleum Corporation (CNPC) and China Petrochemical Corporation (Sinopec) are actively involved in CCUS research and pilot projects.

- CNPC: http://www.cnpc.com.cn/

- Sinopec: http://www.sinopecgroup.com/

- Improved Energy Efficiency: Optimizing the energy utilization efficiency of CTM processes through advanced heat exchanger networks and process integration can reduce overall energy consumption and, consequently, emissions.

- Integration with Renewable Energy: Powering ancillary processes in CTM plants with renewable electricity (solar, wind) can indirectly lower the carbon intensity of the final product.

For Biomethanol (Enhancing Sustainability and Scalability):

- Sustainable Feedstock Sourcing: Ensuring that biomass feedstocks are sustainably harvested or sourced from waste streams to avoid land-use change impacts and competition with food production. Certifications like ISCC (International Sustainability and Carbon Certification) play a crucial role.

- Technological Advancement: Continued investment in research and development to improve the efficiency and cost-effectiveness of biomass gasification and methanol synthesis technologies. This includes novel catalysts and reactor designs.

- Policy Support and Incentives: Government policies, subsidies, and mandates are critical to accelerate the adoption and scale-up of biomethanol production, making it more competitive with fossil-based alternatives. China’s national renewable energy targets and carbon neutrality commitments provide a strong impetus.

- Circular Economy Integration: Developing integrated systems where waste from one industry becomes a feedstock for biomethanol production, fostering a true circular economy.

Conclusion: A Pivotal Shift for China

The comparison between biomethanol and coal-based methanol for cleaner energy in China highlights a clear need for change. Coal-based methanol has long met China’s industrial demands, but its significant environmental impact—including greenhouse gas emissions, air pollution, and high water use—is not sustainable given today’s global climate challenges. Biomethanol, which has a much lower carbon footprint and can utilize waste, presents a vital path toward a cleaner and more sustainable energy future for China.

Transitioning to biomethanol will present challenges. These include the need for large-scale sustainable sourcing of biomass, scaling up technology, and ensuring economic competitiveness. However, increasing investments from companies like Towngas and growing partnerships in green methanol bunkering at ports like Shanghai indicate a promising shift. By focusing on mitigation strategies, investing in renewable technology, and creating supportive policies, China can transform its methanol industry from a major polluter into a leader in clean energy innovation. Moving toward a biomethanol-driven economy is not just an environmental necessity; it’s also a strategic chance for China to build a resilient and sustainable energy future.

Methanol Industry Resources

- Represents methanol industry across five global offices

- Provides market data and methanol price information

- Covers both conventional and renewable methanol production

- Promotes methanol as clean energy resource and chemical building block

- 23 member countries plus European Commission participation

- Task groups publish reports on biomass gasification and conversion

- Focus on sustainable bioenergy systems and circular bioeconomy

- Provides science-based analysis for policy and industry decision makers