Making Advanced Biofuels Cost-Competitive with Carbon Taxation

Advanced biofuels, made from non-food sources such as crop residues, forestry waste, and other organic materials, are one of the most promising solutions for cutting greenhouse gas (GHG) emissions in transport and industry. However, their biggest challenge remains high production costs compared to fossil fuels.

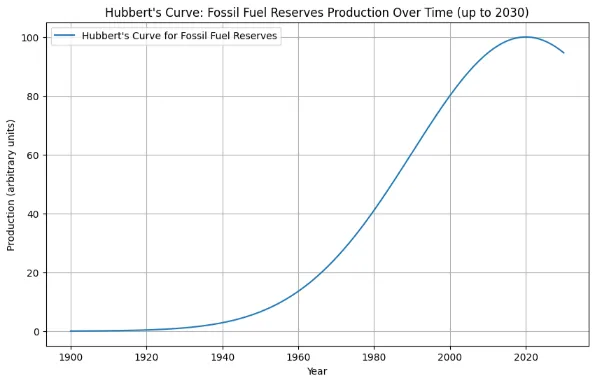

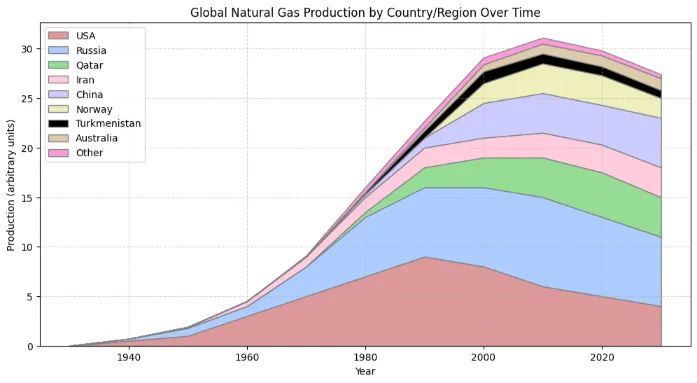

Hubbert’s curve showing fossil fuel reserves production from 1900 up to 2030 (Das et al., 2022).

How Carbon Taxation Effects

The empirical findings demonstrate that carbon taxes can be an effective policy instrument for climate mitigation. An increasing number of studies show that carbon taxes can effectively reduce carbon emissions or at least dampen their growth, although the measured effects are often moderate and insufficient to reach current long-term emission goals, largely due to moderate tax rates and generous exemptions for industry. Crucially, the evidence suggests that carbon taxes typically do not negatively affect economic growth, employment, or competitiveness. The macroeconomic outcomes often depend on how revenues are used: recycling revenues via reductions in social security contributions and taxes on labor income is associated with achieving a “double dividend” (environmental and economic benefits), while lump-sum transfers are economically less efficient for this purpose Köppl, A., & Schratzenstaller, M. (2023).

A carbon tax puts a price on greenhouse gas emissions by making polluters pay for the carbon released from fossil fuels. This increases the cost of coal, oil, and gas, while making cleaner options such as advanced biofuels and renewable energy more attractive.

Global evidence shows that carbon taxation:

- Reduces emissions effectively when tax rates are meaningful.

- Encourages a clean energy transition without harming long-term economic growth or jobs.

- Closes the price gap between fossil fuels and biofuels, improving competitiveness.

Smart Tax Regimes to Boost Biofuels

While a simple carbon tax helps, smart tax regimes make it far more effective by directing revenue to clean energy innovation. Key strategies include:

- Biofuel subsidies and tax credits to reduce production costs (as seen in U.S. Renewable Fuel Standard programs).

- Research and development (R&D) grants to improve biofuel technologies and cut expenses.

- Infrastructure investments in storage, logistics, and supply chains for scaling production.

- Blending mandates that guarantee stable demand and encourage private investment.

- Revenue recycling by reducing labor or business taxes, creating what economists call the “double dividend”—cleaner energy plus stronger economic growth.

A well-known example is British Columbia’s carbon tax, where revenues were reinvested into lowering other taxes and funding green programs, boosting both climate action and public support.

Insights and Challenges from Global Experience

Policymakers often set low carbon tax rates and grant exemptions to industries in order to ease competitiveness concerns and gain public support. While studies show that carbon taxes generally have little negative effect on firms’ competitiveness, policy design such as exemptions and revenue recycling shapes the outcomes. For example, Norway’s generous exemptions for fossil fuel-intensive industries led to only a modest reduction in CO₂ emissions. Such practices weaken environmental effectiveness and make it harder to reach long-term climate goals, but they help balance the trade-off between effectiveness and acceptance. In some cases, exemptions are linked to conditions, as in Denmark, where reduced rates were tied to energy-saving agreements, resulting in significant emission cuts. Overall, the design of exemptions and tax rates varies across countries, explaining why macroeconomic impacts are often neutral or even positive.

- Effectiveness depends on design: higher rates reduce emissions faster, while too many exemptions weaken impact.

- Revenue use matters: directing funds to low-carbon innovation, public compensation, and energy transition programs increases acceptance.

- Social fairness is crucial: policies that support lower-income households and ensure transparency win more trust and political backing.

- Carbon pricing alone is not enough: it must be part of a comprehensive renewable energy policy mix that includes innovation, infrastructure, and regulations.

Conclusion: Carbon Taxation as a Catalyst for Biofuels

The evidence is clear: carbon taxation, when combined with smart tax policies, can make advanced biofuels cost-competitive and accelerate the global transition to a low-carbon economy. By pricing carbon emissions, supporting clean energy investments, and designing fair and transparent revenue use, governments can:

- Drive sustainable innovation in biofuels.

- Cut dependence on fossil fuels.

- Meet climate goals while protecting economic growth and fairness.

To achieve a truly sustainable energy future, To ensure that carbon taxes are environmentally effective and politically feasible, several solutions are suggested, beginning with the implementation of sufficiently high tax rates necessary to adequately trigger emissions reduction and innovation, as current moderate rates are often insufficient to meet long-term goals. Given that carbon taxation alone cannot achieve the profound structural change required for climate neutrality, it must be embedded in a broader policy mix that includes instruments like subsidies, standards, and public infrastructure investments. Revenue recycling is critical for maximizing benefits and gaining public acceptance: policymakers should utilize reductions in taxes on labor income and social security contributions to pursue a potential “double dividend” of environmental and economic benefits, while simultaneously using lump-sum transfers to effectively mitigate regressive effects for lower incomes and boost public acceptance. Furthermore, compensation measures must address not only vertical (income-based) but also horizontal distributional effects (based on socio-demographic factors like location). Finally, securing public support is achieved by providing public information about the positive impact of the tax and the future costs of inaction, and acceptance can be increased by channeling part of the revenues into “environmental projects”. carbon taxation must be embedded in a broader policy package that fosters innovation, builds infrastructure, and ensures public acceptance. Done right, advanced biofuels can become a cornerstone of the clean energy transition.

Citations

Köppl, A., & Schratzenstaller, M. (2023). Carbon taxation: A review of the empirical literature. Journal of Economic Surveys, 37(4), 1353-1388.

Das, H. S., Salem, M., Zainuri, M. A. A. M., Dobi, A. M., Li, S., & Ullah, M. H. (2022). A comprehensive review on power conditioning units and control techniques in fuel cell hybrid systems. Energy Reports, 8, 14236–14258.

Also checkout

Leveraging public and private funding for innovation in advanced biofuel conversion pathways