Powering a Greener Future: Financing Opportunities for First-of-a-Kind (FoAK) Advanced Biofuel Plants

The global push for decarbonization has put advanced biofuels in the spotlight. Unlike first-generation biofuels derived from food crops, First-of-a-Kind (FoAK) advanced biofuel plants utilize non-food sources like agricultural residues, forestry waste, and even municipal solid waste. These fuels are “drop-in” replacements for fossil fuels, meaning they can be used in existing infrastructure and engines, making them a critical component in the transition to a low-carbon economy, especially for hard-to-abate sectors like aviation, shipping, and heavy-duty transport.

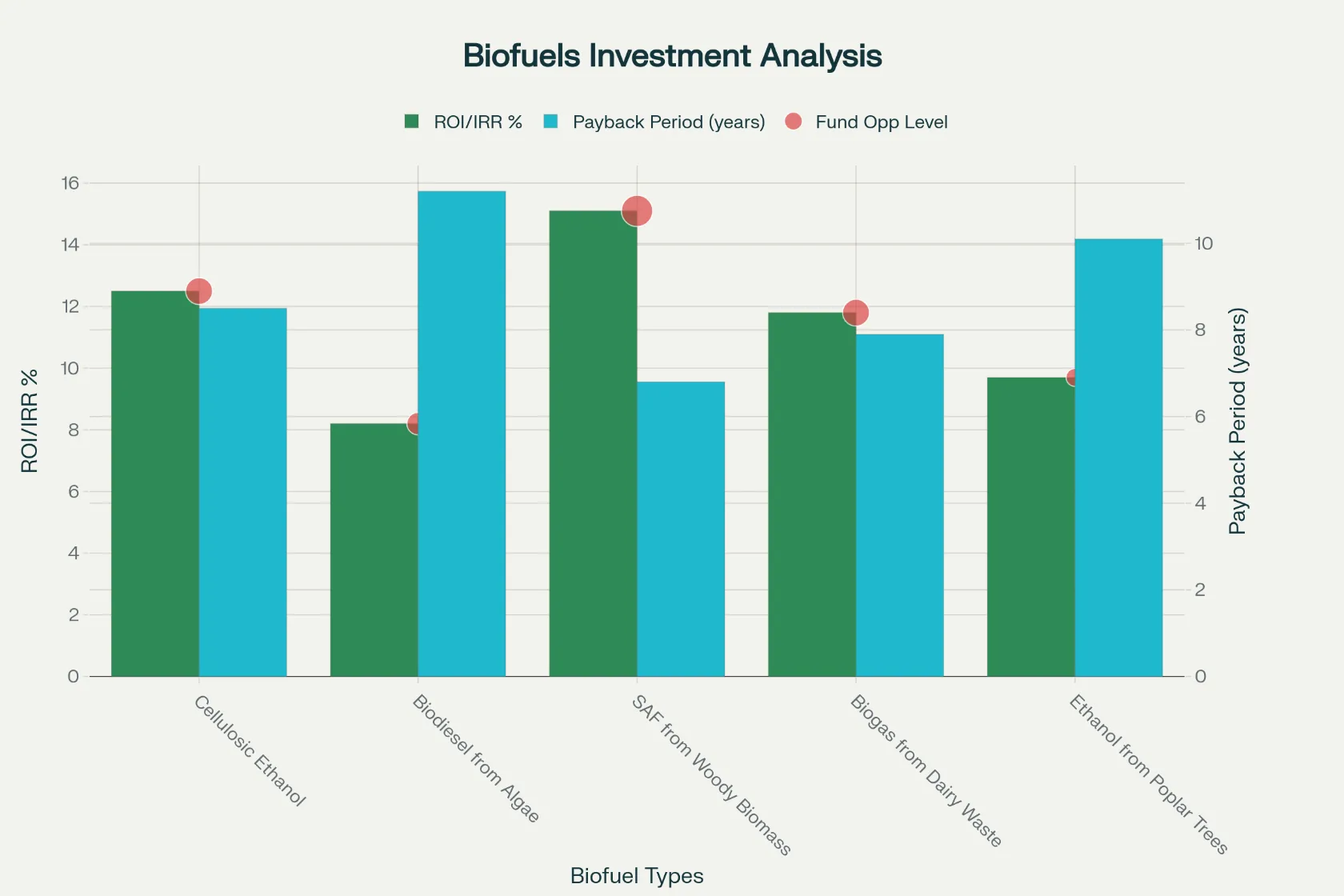

What are the possible FoAK Advance biofuels for Financial opportunities

Investing in First-of-a-Kind (FoAK) advanced biofuel plants presents a compelling financial opportunity due to the diversity of technologies and the high demand for sustainable fuels. A significant number of these projects are focused on a variety of feedstocks, going beyond traditional agricultural residues and forestry waste. Key FoAK advanced biofuel plants are emerging that utilize innovative sources like waste from dairy products, which can be converted into bioethanol or bio-oil using fermentation or thermochemical processes. Fast-growing, non-food crops such as genetically optimized poplar trees are another promising feedstock, as their high cellulose and low lignin content make them ideal for conversion into cellulosic ethanol. Other sources include the biodegradable fraction of municipal and industrial waste, which can be processed through technologies like gasification or fast pyrolysis to produce liquid fuels, and even animal fats and used cooking oils, which are hydrotreated to create renewable diesel and sustainable aviation fuel (SAF). These diverse and often localized feedstocks provide investors with a wide range of opportunities to tap into a rapidly growing market while simultaneously addressing waste management and resource efficiency.

Regional and Economical Viability

The regional and economic viability of First-of-a-Kind (FoAK) advanced biofuel plants is highly dependent on the local availability of diverse and low-cost feedstocks. Economically, these projects are most attractive when they can co-locate with a source of waste or a dedicated, fast-growing energy crop. For instance, plants utilizing dairy waste are most viable in regions with a high concentration of dairy farms, as this minimizes transportation costs and provides a reliable, year-round feedstock stream that also offers a solution to an existing waste management problem. Similarly, facilities converting poplar trees or other dedicated energy crops are particularly suited to regions with available marginal land and favorable growing conditions. The economic model is further enhanced by policies that incentivize waste-to-energy projects and by the valorization of co-products, such as bio-fertilizer or renewable electricity generated from the plant’s byproducts, which can be sold back to the grid or used to power the facility, thereby increasing the overall profitability and regional economic benefits.

1- Cellulosic Ethanol

Technique used in manufacturing:

The primary manufacturing techniques are biochemical and thermochemical conversion.

- Biochemical Process: This involves a pretreatment phase to break down the lignocellulosic material. This is followed by hydrolysis, which uses enzymes or dilute acid to break down cellulose into simple sugars. These sugars are then fermented by microbes into ethanol.

- Thermochemical Process: This method uses heat and chemicals to convert biomass into syngas, a mixture of hydrogen and carbon monoxide. This syngas is then catalytically converted into ethanol and other liquid products.

Feedstock:

Cellulosic ethanol is produced from lignocellulosic biomass, which is non-food plant material. This includes agricultural residues (like corn stover and wheat straw), herbaceous biomass (like switchgrass), woody biomass (like poplar and pine trees), and municipal solid waste.

Funding Opportunities:

Global investment in cellulosic ethanol has declined in recent years, with a 35% drop in new biofuels power capacity investment in 2015 compared to 2014, reaching $3.1 billion. This decline is largely due to high production costs and the financial instability of pioneering companies, despite successful pilot and demonstration plants in the US, EU, and elsewhere. Funding is often directed toward projects that demonstrate cost-effective, scalable technologies or offer new insights into commercial viability (Sharma et al., 2022). Cellulosic ethanol remains a promising but under-commercialized biofuel, with future funding opportunities closely tied to technological breakthroughs, integrated biorefinery models, and supportive policy frameworks. The next wave of investment is expected to focus on overcoming persistent cost and scalability barriers while maximizing the value of lignocellulosic biomass.

Regional viability:

This biofuel is most viable in regions with abundant agricultural and forestry resources. The U.S. Midwest, with its vast corn production, is a prime location for utilizing corn stover. The Pacific Northwest and Southeast, with their large forestry industries, are ideal for using woody biomass.

ROI (Return on Investment):

The ROI for cellulosic ethanol plants can be challenging due to high initial capital costs, but it is projected to improve as technology advances and economies of scale are achieved. Recent techno-economic analyses show that cellulosic ethanol production costs typically range from $0.81 to $1.44 per liter (about $3.07–$5.45 per gallon), depending on the process and feedstock used. A meta-analysis of studies found the minimum fuel selling price (MFSP) averages $2.65/gallon, with a wide range from $0.90 to $6.00/gallon, reflecting significant variability in technology, scale, and assumptions. At a selling price of $1.50/L, some models achieve a positive net present value (NPV), but profitability is highly sensitive to process yields and capital costs (Olughu et al., 2023).

2- Biodiesel from Algae

Technique used in manufacturing:

The process involves three main stages:

- Cultivation: Microalgae are grown in either open ponds or closed photobioreactors, which provide the necessary sunlight, water, and carbon dioxide.

- Harvesting and Oil Extraction: The algae biomass is harvested from the water, and the natural oils (lipids) are extracted. Common methods include oil presses or solvent extraction.

- Transesterification: The extracted algal oil is reacted with an alcohol (like methanol) and a catalyst to produce biodiesel.

Feedstock:

Microalgae and macroalgae. A key advantage is that algae can be grown on non-arable land and in a variety of water sources, including wastewater and saline water, which does not compete with food crops.

Funding Opportunities:

Funding opportunities are emerging across several dimensions to address these hurdles. Public funding plays a critical role, with national and regional programs in the US, EU, China, and Brazil supporting research, pilot projects, and demonstration plants, while policies such as renewable fuel standards, tax credits, and capital cost grants enhance economic feasibility and attract private investors. Research and innovation grants prioritize solutions for key bottlenecks, including improving algal strain productivity, lowering cultivation and harvesting costs, and advancing efficient lipid extraction and conversion methods, with additional emphasis on integrating algae cultivation with wastewater treatment and CO₂ capture to reduce costs and deliver environmental benefits. Furthermore, funding is increasingly directed toward biorefinery models that couple biodiesel production with high-value co-products such as biofertilizers, bioplastics, and nutraceuticals, making projects more attractive to both public and private stakeholders by enhancing profitability and sustainability .

Regional viability:

Algae-based biofuel production is most viable in regions with a high number of daylight hours per year, such as tropical or subtropical climates. Access to low-cost water sources (including wastewater) and abundant carbon dioxide (e.g., from industrial emissions) is also crucial for commercial viability.

ROI (Return on Investment):

Updated techno-economic analyses estimate current algal biodiesel production costs at $0.42–$0.97 per liter ($1.59–$3.67 per gallon), which is still higher than fossil diesel but shows improvement over earlier estimates.

ROI Examples: A recent techno-economic study of a macroalgae-based biodiesel plant reported a return on investment (ROI) of 25.39% and an internal rate of return (IRR) of 31.13%, with a payback period of 3.94 years—though these figures are highly dependent on scale, technology, and local conditions (Ravichandran et al., 2023).

3- Sustainable Aviation Fuel (SAF) from Woody Biomass

Technique used in manufacturing:

One prominent technique is catalytic fast pyrolysis (CFP) followed by hydrotreating. In this process, woody biomass is heated rapidly in the absence of oxygen to produce bio-oil. This stabilized bio-oil is then hydrotreated to remove impurities and upgraded into a drop-in ready sustainable aviation fuel.

Feedstock:

Woody biomass, including forest residues (like treetops, branches, and sawdust), as well as dedicated woody energy crops.

Funding Opportunities:

The current funding landscape is shaped by federal, state, and local programs, with the U.S. Inflation Reduction Act (2022) introducing new federal tax credits that provide a foundational layer of support for SAF producers. However, state-level incentives remain necessary to achieve cost competitiveness; for instance, pilot-scale gasification Fischer-Tropsch (GFT) SAF production in Virginia would require approximately $3.61 per gallon in state incentives, while pyrolysis-based SAF would need around $0.75 per gallon. A mix of funding mechanisms—such as tax credits, loan forgiveness, and direct grants plays a critical role in shaping project economics and ensuring benefits for stakeholders, from feedstock suppliers to conversion facilities. Strategic funding priorities include advancing technology development to improve conversion efficiency, scale up production, and reduce costs across woody biomass-to-SAF pathways, alongside investments in supply chain logistics, facility siting, and blending infrastructure to enable regional deployment. At the same time, policymakers face the challenge of balancing economic feasibility with environmental benefits, as lower-cost pathways do not always deliver the highest greenhouse gas reductions, underscoring the need for carefully designed incentives that maximize both sustainability and market viability (Davis et al., 2024).

Regional viability:

Production of woody biomass SAF is most viable in regions with large, accessible, and sustainably managed forests. This includes areas like the Pacific Northwest, the Southeastern U.S., and parts of Canada and Northern Europe.

ROI (Return on Investment):

Recent techno-economic models estimate SAF from woody biomass costs between $1.92–$2.25 per liter ($7.27–$8.52 per gallon) using the Ethanol-to-Jet (ETJ) pathway, depending on production scale and demand . Fischer-Tropsch (FT) pathways show production costs of $2.31–$2.81 per gallon gasoline equivalent . Integration with existing bioethanol plants or use of economic incentives can reduce costs to as low as $0.40–$0.70 per liter ($1.51–$2.65 per gallon) (Guimarães et al., 2023) Hong et al. (2025).

Cost Drivers: Capital investment accounts for about 77% of total unit cost, with operating costs at 22% . Feedstock price and renewable fuel incentives are the most sensitive variables affecting ROI .

ROI Potential: Standalone woody biomass SAF projects struggle to achieve positive ROI at current market prices without policy support. However, integration with mature biofuel routes and carbon credit incentives can make projects profitable, with some models showing high probabilities (>96%) of profitability at current SAF prices in favorable policy environments .

4- Biogas from Dairy Waste

Technique used in manufacturing:

Anaerobic Digestion is the primary process. This involves placing dairy waste (manure, wastewater, whey) into a sealed, oxygen-free tank called a digester. Microbes naturally break down the organic material, producing a biogas rich in methane, which can be captured and used as fuel.

Feedstock:

Dairy waste, including manure, wastewater, and dairy processing by-products like whey.

Funding Opportunities:

Many countries and regions provide direct subsidies, grants, and cost-share programs to support the construction and operation of anaerobic digesters on dairy farms, helping reduce methane emissions and promote renewable energy. In California, governmental incentive programs partially fund eligible dairy digester projects, while in Poland and other EU countries, subsidies often cover 40–60% of the investment cost for biogas plants, a level of support necessary to ensure satisfactory economic efficiency. In addition to grants and subsidies, soft loans and low-interest financing from government and private sources are available, further encouraging rural and community-level biogas development and improving the overall financial viability of such projects Kusz et al. (2024).

Regional viability:

This biofuel is highly viable in regions with a dense population of dairy farms, such as the U.S. Midwest, California’s Central Valley, and parts of Europe.

ROI (Return on Investment):

Most studies indicate payback periods for anaerobic digestion projects ranging from 4 to 13 years, depending on plant size, technology, co-digestion practices, and the availability of subsidies. For instance, a 400-cow farm in Iran achieved payback in under 4 years, generating annual net incomes of $6,400–$38,000 depending on the scenario, while a 500 kW biogas plant in Poland using dairy manure and straw reported a payback of less than 6 years and €332,000/year more profit compared to conventional dairy farming. In contrast, small-scale plants in Ireland demonstrated longer payback periods of 8–13 years, though capital grants improved their economic feasibility. Internal Rates of Return (IRR) generally range between 9% and 15% for well-designed, subsidized, or co-digestion projects, as seen in a Malaysian on-farm system reporting a 13% IRR with a 7-year payback (Bywater & Kusch-Brandt, 2022). Net Present Value (NPV) also tends to be positive for medium-to-large farms or when co-digestion strategies, such as integrating food waste or straw, are adopted further enhanced by tipping fees that significantly improve overall returns

5- Ethanol from Poplar Trees

Technique used in manufacturing:

The process is similar to cellulosic ethanol from other woody biomass. It involves a pretreatment phase (often with steam or chemicals) to break down the lignin and hemicellulose. This is followed by enzymatic hydrolysis to convert the cellulose into fermentable sugars, which are then fermented into ethanol.

Feedstock:

Hybrid poplar trees, which are cultivated as a fast-growing, short-rotation energy crop.

Funding Opportunities:

Government and research grants for poplar-based ethanol are available through national and regional programs targeting advanced biofuels, such as the USDA NIFA in the US and the EU Renewable Energy Directive II (REDII) in Europe, which support research, demonstration, and pilot projects, particularly those utilizing marginal lands or integrating ecosystem services. Economic analyses and stakeholder assessments emphasize the importance of direct subsidies, capital grants, and policy incentives to ensure competitiveness with fossil fuels and other biomass sources, since purpose-grown poplar often faces higher feedstock costs that make it financially unfeasible without such support. In addition, poplar plantations can benefit from ecosystem service payments through programs that reward land restoration, flood mitigation, or wastewater management, creating diversified revenue streams for growers and enhancing the overall economic viability of poplar-based ethanol production.

Regional viability:

Poplar-based biofuel is most viable in temperate regions with suitable land for short-rotation woody crop plantations, such as the Pacific Northwest and parts of the Midwest in the U.S., as well as certain regions of Canada and Europe.

ROI (Return on Investment):

Production Costs: Recent techno-economic analyses estimate the minimum ethanol selling price (MESP) for poplar ethanol at $1,095/tonne, or roughly $2.65/gallon—comparable to the average for cellulosic ethanol but above current market prices for gasoline and first-generation biofuels .

Profitability: ROI is highly sensitive to feedstock price, plant scale, and technology. Large-scale plants with optimized processes and policy support can achieve positive net present value (NPV) and internal rates of return (IRR), but unsubsidized projects often struggle to be profitable (Pei et al., 2024).

Key Metrics: Payback periods and IRR are rarely reported directly, but positive NPV and profitability are possible in integrated biorefinery models or with strong policy incentives.

Conclusion

The advanced biofuels and techniques discussed in this report represent a critical step toward a more sustainable energy future. The examples of cellulosic ethanol, algae biodiesel, sustainable aviation fuel from woody biomass, and biofuels from dairy waste and poplar trees highlight the diversity of feedstocks and conversion technologies available. It’s important to note that these are just a few examples; many other promising techniques and feedstocks are being developed and commercialized around the world. As technology continues to improve and policy frameworks evolve, advanced biofuels will play an increasingly vital role in decarbonizing the transportation and industrial sectors.

Citations

Sharma, J., Kumar, V., Prasad, R., & Gaur, N. (2022). Engineering of Saccharomyces cerevisiae as a consolidated bioprocessing host to produce cellulosic ethanol: Recent advancements and current challenges.. Biotechnology advances, 107925 . https://doi.org/10.1016/j.biotechadv.2022.107925.

Olughu, O., Tabil, L., Dumonceaux, T., Mupondwa, E., Cree, D., & Li, X. (2023). Technoeconomic analysis of a fungal pretreatment-based cellulosic ethanol production. Results in Engineering. https://doi.org/10.1016/j.rineng.2023.101259.

Ravichandran, P., Rajendran, N., Al-Ghanim, K., Govindarajan, M., & Gurunathan, B. (2023). Investigations on evaluation of marine macroalgae Dictyota bartayresiana oil for industrial scale production of biodiesel through technoeconomic analysis.. Bioresource technology, 128769 . https://doi.org/10.1016/j.biortech.2023.128769.

Davis, C., Sreekumar, S., Altman, R., Clarens, A., Lambert, J., & Colosi, L. (2024). Geospatially Explicit Technoeconomic Assessment of Sustainable Aviation Fuel Production: A Regional Case Study in Virginia. Fuel Communications. https://doi.org/10.1016/j.jfueco.2024.100114.

Guimarães, H., Bressanin, J., Motta, I., Chagas, M., Klein, B., Bonomi, A., Filho, M., & Watanabe, M. (2023). Decentralization of sustainable aviation fuel production in Brazil through Biomass-to-Liquids routes: A techno-economic and environmental evaluation. Energy Conversion and Management. https://doi.org/10.1016/j.enconman.2022.116547.

Hong, J., Chen, B., Wang, T., & Zhao, X. (2025). A promising technical route for converting lignocellulose to bio-jet fuels based on bioconversion of biomass and coupling of aqueous ethanol: A techno-economic assessment. Fuel. https://doi.org/10.1016/j.fuel.2024.133670.

Kusz, D., Kusz, B., Wicki, L., Nowakowski, T., Kata, R., Brejta, W., Kasprzyk, A., & Barć, M. (2024). The Economic Efficiencies of Investment in Biogas Plants—A Case Study of a Biogas Plant Using Waste from a Dairy Farm in Poland. Energies. https://doi.org/10.3390/en17153760.

Bywater, A., & Kusch-Brandt, S. (2022). Exploring Farm Anaerobic Digester Economic Viability in a Time of Policy Change in the UK. Processes. https://doi.org/10.3390/pr10020212.

Pei, X., Fan, M., Zhang, H., & Xie, J. (2024). Assessment for industrial production of poplar ethanol after analysis of influencing factors and predicted yield. Cellulose. https://doi.org/10.1007/s10570-024-06236-6

Exploring Regional Biomass Supply Hubs: Business Potential and Funding Mechanisms