China’s Green Tidal Wave: How 30 Million Tonnes of Methanol Capacity is Decarbonizing Global Shipping and Charting a Course for the World

The global shipping industry, a colossal engine of international commerce, faces an undeniable mandate: decarbonization. This challenge is not merely about shifting fuels but establishing entirely new supply chains, production infrastructures, and commercial paradigms at a world-spanning scale. Against this backdrop of urgency and immense logistical complexity, the announcements emerging from China, detailed at the Argus Green Marine Fuels Asia conference in Singapore, represent far more than local business development; they constitute a strategic blueprint for the world’s transition to clean maritime fuel. Chinese green energy firms, by championing the development of biomethanol plants, are establishing green methanol as the singularly attractive, high-volume option to purify the global shipping fleet’s carbon footprint, setting critical goals and directions for every nation to follow.

Biomethanol production in China using rice straw, bagasse, or other biomass can reduce CO₂ emissions by 54–59% compared to coal-based methanol, and even achieve carbon-negative outcomes in some integrated processes (Su et al., 2024).

The initial analysis of the market confirms the strategic positioning of green methanol. According to Shutong Liu, founder of biofuel brokerage Motion Eco, the immediate future of alternative marine fuels is a two horse race: Used Cooking Oil (UCO) methyl ester (Ucome) based marine biodiesel and green methanol. However, the same expert points to a fundamental constraint that elevates biomethanol’s long-term importance. The supply of feedstock UCO is inherently limited and must be distributed across an ever-growing array of sectors, including marine bio-bunkering, on road transportation, and, critically, aviation fuel demand. This competition for limited UCO resources essentially places a ceiling on the growth potential of marine biodiesel. Consequently, biomethanolwhich utilizes biomass as its feedstock is strategically positioned for greater future expansion, making the Chinese focus on it a prescient move that secures a scalable fuel source for the long haul, benefitting the ultimate goal of full maritime decarbonization.

The scale of China’s commitment is what provides the most profound benefit to the global biomethanol goal. The sheer ambition, as disclosed by Liu, involves Chinese green methanol suppliers announcing over 100 projects designed to collectively produce a staggering volume of more than 30 million tonnes per year (t/yr) of green methanol. However, current production costs for biomethanol are 3–5 times higher than coal-based methanol (e.g., 2685 RMB/t vs. 1593 RMB/t), mainly due to high capital and feedstock costs (Bazaluk et al., 2020, p. 3).. This massive capacity commitment shatters previous conceptions of what is commercially possible in the alternative fuel space. The planned projects are strategically divided, comprising 12 million t/yr of biomethanol capacity and 18 million t/yr of e-methanol capacity.

This immense, multi-million-tonne annual capacity is the single most important factor benefiting the biomethanol goals. By injecting such a massive projected supply into the market, these projects move biomethanol from being a boutique, trial fuel to a globally relevant, commercially validated commodity. This volume provides the necessary confidence for naval architects to design new vessels optimized for methanol, for ports to invest in bunkering infrastructure, and for financial markets to confidently back further production initiatives globally. It signals an irreversible commitment to the fuel’s future. In essence, China is single-handedly building the required industrial base to transition a segment of the global shipping industry.

Concrete examples of this commitment provide a tangible direction for the rest of the world. The energy, chemical engineering, and food equipment firm CIMC Enric is already constructing a biomethanol plant in Zhanjiang, Guangdong. This facility is planned to produce 50,000 t/yr by the fourth quarter of 2025, with a clear, aggressive scaling path targeting an increase to 200,000 t/yr by 2027, as stated by the company’s director, David Wang. The accompanying detail—that the factory includes 20,000 tonnes of storage capacity for biomethanol—underscores that this is not just a theoretical capacity announcement but a firm investment in physical infrastructure. Similarly, the Chinese wind turbine supplier and biomethanol producer GoldWind is pursuing an even larger capacity goal. Their plans involve the start-up of two substantial 250,000 t/yr biomethanol plants, with one unit scheduled to commence operations by the end of 2025 and the second following in late 2026, according to company vice-president Chen Shi. These hard deadlines, associated with significant and verifiable industrial capacity, define a goal-setting direction based on timely execution.

Furthermore, China’s projects offer critical insights into the preferred technological pathways for meeting immediate decarbonization goals. Biomethanol is produced by converting biomass into syngas through a process of gasification, frequently supplemented with the addition of green hydrogen, before reacting with a catalyst to synthesize the final methanol product. This is a relatively established chemical engineering process. While the overall Chinese plan includes a substantial 18 million t/yr of e-methanol—produced by combining captured CO2 with green hydrogen—the market perspective presented is telling. E-methanol is currently viewed as “far less commercially viable” than biomethanol due to a combination of higher production costs and less established technological maturity. The world can learn from this strategic insight: to meet pressing, near-term goals, the focus should initially be placed on the commercially ready, cost-effective, and scalable biomethanol pathway, using the e-methanol route as a critical but longer-term objective. The versatility of both fuels, which share identical molecular properties with conventional fossil methanol, further simplifies the transition, as they can be blended with the traditional fuel for immediate marine usage without requiring radical engine changes across the global fleet.

However, the Chinese experience also illuminates the commercial and financial directions that must be set globally. Panellists at the conference highlighted that ‘money matters,’ citing a slowing Chinese economy and high initial investment costs as significant barriers to quickly ramping up biomethanol production. This global challenge requires a global solution, and the Chinese firms have provided the perfect model for de-risking these massive investments.

Susana Germino, Swire’s shipping and bulk chief sustainability officer, emphasized the need for securing long-term offtake agreements (LTAs) with reputable end-users to progress green fuel projects at scale. This model is being directly applied by Chinese producers. Crucially, GoldWind’s experience offers the ultimate blueprint: they signed a long-term offtake agreement for biomethanol with the Danish container shipping giant Maersk in 2023. This LTA, a critical commercial guarantee, directly enabled the project to reach a Final Investment Decision (FID) on its Inner Mongolia biomethanol unit the following year. This sequence—LTA first, then FID—is arguably the most important direction the world can glean from the Chinese projects. It is a model of shared risk and mutual commitment, whereby shipowners provide the demand assurance necessary to unlock the billions of dollars needed for production infrastructure.

The final financial hurdle is pricing. Shutong Liu noted that green methanol must benchmark itself against its primary rival, marine biodiesel, to attract the necessary buyers, a challenge compounded by green methanol’s higher production costs. This is further complicated by the fact that marine biofuels like biodiesel are often seen as more attractive because they are “operationally easier to bunker.” The direction for the world, therefore, must be to follow China’s lead in achieving unparalleled scale to drive down unit production costs, while simultaneously innovating to simplify the bunkering and handling operations to achieve competitive parity with biodiesel.

In conclusion, the collective announcement of over 30 million t/yr of green methanol capacity by Chinese firms serves as a powerful, non-negotiable benchmark for the world. It is the clearest articulation yet of how to achieve global biomethanol goals. The directions set by China are precise:

- Prioritize Scale: Target multi-million-tonne annual capacity to ensure global supply and drive down costs.

- Strategic Feedstock Use: Acknowledge the constraint of UCO and strategically pivot towards the more scalable biomethanol pathway.

- De-Risk Investment with LTAs: Adopt the GoldWind/Maersk model of securing long-term offtake agreements before making the final investment decision.

- Execute on Tangible Infrastructure: Follow the CIMC Enric example of committing to hard deadlines, concrete facilities, and verifiable storage capacity.

By blending state-backed ambition with clear-eyed commercial execution and a focus on proven technologies, China’s green methanol projects are not just a domestic initiative; they are the most comprehensive, detailed, and aggressive blueprint available to the international maritime community, demonstrating exactly what is required to make clean shipping a global reality. The age of green methanol has begun, and the course for the world has been charted from the east.

Viability of CHINESE MODEL

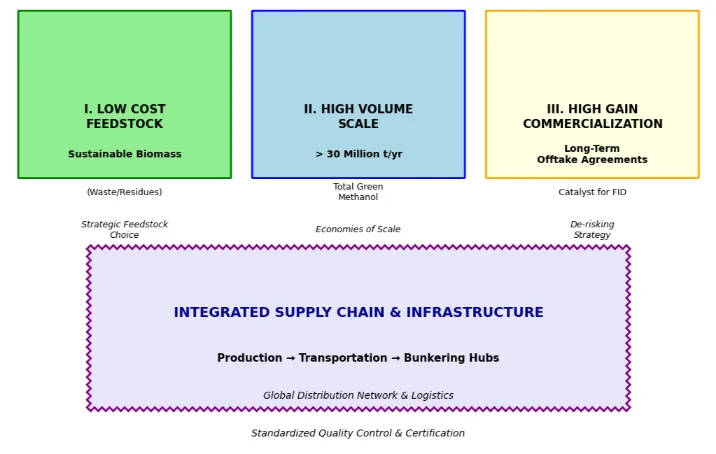

The viability of China’s “low-cost and high-gain” biomethanol model for global adoption is best viewed as a successful blueprint for scale, not a guaranteed replication of cost. China’s commitment to building over 100 green methanol projects, including 12 million tonnes per year of bio-methanol capacity, offers the critical benefit of industrial scale necessary to drive down long-term technology and production costs worldwide. Furthermore, their strategy of securing long-term offtake agreements (LTAs) with major shippers like Maersk before reaching Final Investment Decision (FID) provides a proven commercial mechanism for de-risking massive capital investments—a vital lesson for nations struggling to finance their own decarbonization projects. This focus on integrated supply chains, from production in biomass-rich regions to bunkering at major ports, demonstrates the necessary high-gain structure required for international maritime fuel supply.

However, replicating the “low-cost” element globally faces significant challenges rooted in local economic disparities and feedstock logistics. While China may produce the fuel cheaply relative to global green alternatives, its cost remains higher than conventional fossil fuels, necessitating the establishment of robust government incentives or carbon pricing schemes—policies that vary widely outside of China. Crucially, the model relies on the large, centralized availability of specific low-cost biomass and waste feedstocks, which may not be transferable to countries with different agricultural practices or waste management systems. Therefore, while the high-gain strategy of massive scaling, integrated infrastructure, and commercial de-risking is highly viable and essential for global adoption, the low-cost element will only materialize for other countries if they can overcome these local feedstock and policy hurdles.

Scalability of China’s Green Methanol Blueprint for Global Fuels

The viability of China’s “low-cost and high-gain” biomethanol model for global fuel adoption lies in its successful blueprint for industrial scale and commercial de-risking, principles that are highly transferable to other green fuels like green hydrogen, ammonia, and advanced biofuels. The model’s core strength is its strategy of leveraging massive capacity build-outs to achieve long-term economies of scale, a necessary step for any high-CAPEX, emergent green energy technology to compete with fossil fuels. Crucially, the focus on securing Long-Term Offtake Agreements (LTAs) with major shipping companies before Final Investment Decision (FID) provides a robust commercial mechanism for de-risking capital investments. This financing strategy is universally applicable and essential for funding green hydrogen and green ammonia projects, where significant upfront investment in electrolyzers and renewable energy is the main barrier to entry.

However, the “low-cost” pillar of the model faces varied constraints when applied to different fuels, primarily driven by feedstock and logistical complexities. For hydrogen and ammonia, the “feedstock” is renewable electricity, making the model’s cost achievable only in regions with abundant, cheap solar and wind resources. In contrast, other advanced biofuels, like Sustainable Aviation Fuel (SAF) made from Used Cooking Oil (UCO), often face a severe global constraint on feedstock availability, preventing the massive volume scaling that the methanol model relies upon. Furthermore, while liquid e-fuels like ammonia and e-methanol benefit from existing transport infrastructure, pure green hydrogen requires entirely new, expensive transport and storage infrastructure. Therefore, while the commercial de-risking and scale-up components of China’s model are a vital global roadmap, the low-cost outcome is contingent upon resolving these specific local feedstock and infrastructure challenges for each unique fuel type.

Citatiuons

Su, G., Jiang, P., Zhou, H., Zulkifli, N., Ong, H., & Ibrahim, S. (2024). Integrated production of methanol and biochar from bagasse and plastic waste: A three-in-one solution for carbon sequestration, bioenergy production, and waste valorization. Energy Conversion and Management. https://doi.org/10.1016/j.enconman.2024.118344.

Bazaluk, O., Havrysh, V., Nitsenko, V., Baležentis, T., Štreimikienė, D., & Tarkhanova, E. (2020). Assessment of Green Methanol Production Potential and Related Economic and Environmental Benefits: The Case of China. Energies. https://doi.org/10.3390/en13123113