The Fuel of the Future: A New Path for Tough-to-Clean Industries

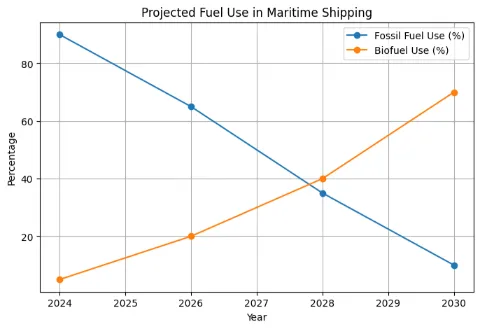

In the global effort to reduce carbon emissions, certain sectors present a notably significant challenge. Long-haul air travel, maritime shipping, and heavy-duty transportation—key components of the global economy—remain resistant to alternatives to liquid fossil fuels. As the world pushes toward a sustainable energy future, the search for a viable, large-scale alternative is more urgent than ever. This is where advanced biofuels enter the picture, not as a peripheral solution but as a critical component of the energy transition.

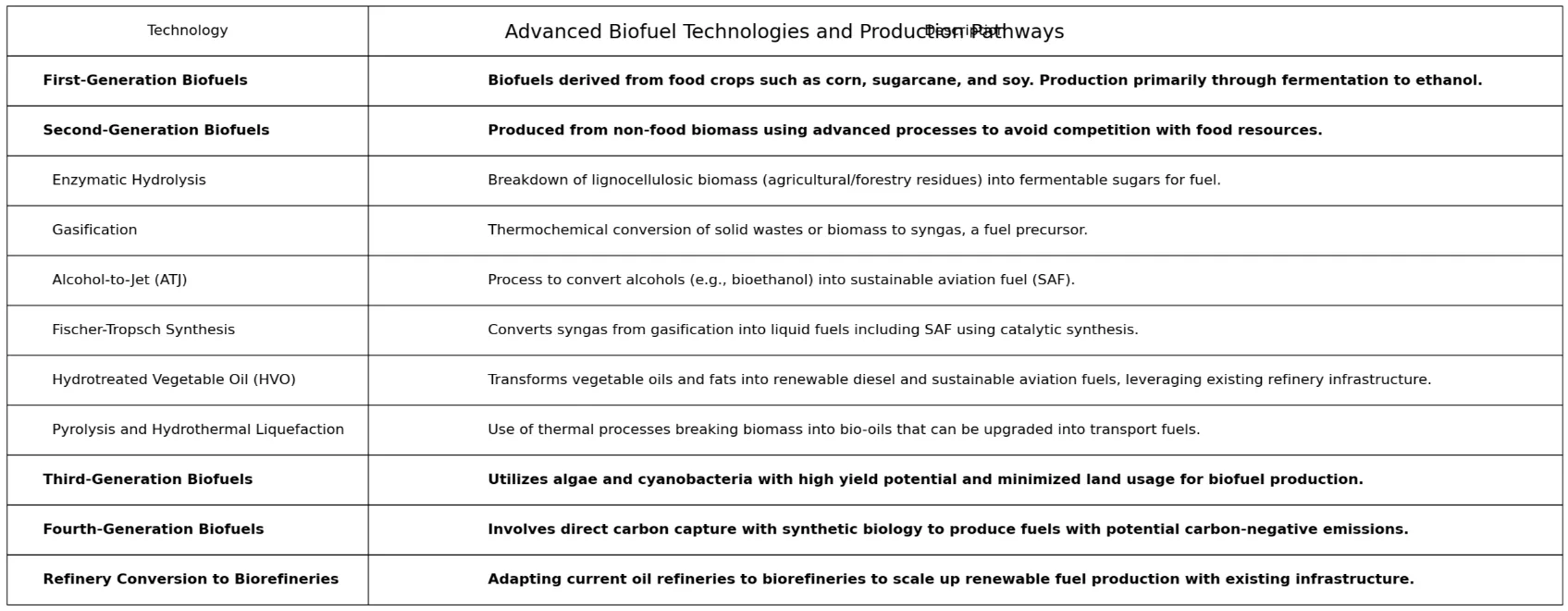

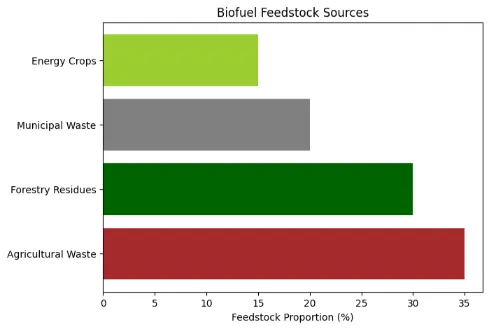

Unlike their controversial first-generation predecessors, which rely on food crops, advanced biofuels are derived from non-food sources like agricultural waste, forestry residues, and municipal solid waste. This innovative approach sidesteps the contentious “food versus fuel” debate and offers a cleaner, more sustainable pathway to reducing carbon emissions. The potential of this market is immense, with projections indicating a compound annual growth rate (CAGR) of 38.5% from 2024 to 2030, which would see the market swell to an estimated US$965.1 billion.

However, the path from technological promise to widespread commercialization is fraught with significant challenges. A substantial funding shortfall is currently holding back the advanced biofuels industry—a “valley of death” that exists between promising research and development and widespread commercial adoption. Closing this gap requires more than just innovation; it necessitates a comprehensive, multi-faceted approach that includes financial support and the strategic allocation of green funds. This analysis will explore how a blend of public and private capital can accelerate the scale-up of advanced biofuel technologies, transforming a high-risk venture into a cornerstone of a net-zero economy.

Overcoming Critical Barriers in Biofuel Commercialization

The most significant barrier to the widespread adoption of advanced biofuels is economic. The production costs for these next-generation fuels are often two to three times higher than their fossil fuel counterparts. For instance, a comprehensive cost analysis reveals a significant gap of between 40 and 130 EUR/MWh when comparing advanced biofuels to fossil fuels, which typically sit in the range of 30-50 EUR/MWh. This disparity makes it difficult for new projects to compete on price and secure the long-term, low-interest debt financing they need to get off the ground.

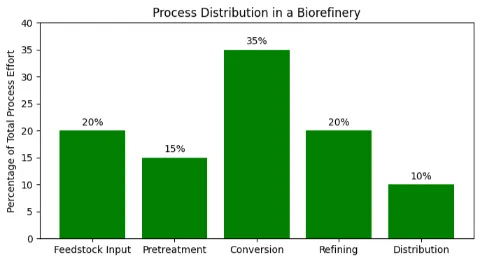

A major reason for this cost gap is the capital-intensive nature of building “first-of-a-kind” (FOAK) biorefineries. These plants require massive upfront investments, often running into hundreds of millions or even billions of dollars. The perceived high risk of an unproven technology and the lack of clear, immediate profitability make private investors hesitant to commit the necessary capital. This creates a vicious cycle: without investment, the industry cannot achieve the economies of scale that would reduce costs, and without lower costs, it struggles to attract the very investment it needs.

Beyond the economic hurdles, advanced biofuels face formidable logistical and technical challenges. The feedstocks, such as agricultural and forestry waste, are often seasonal and geographically dispersed. Their low bulk density—for example, a typical dry bulk density of grasses and crop residues is only about 70 kg/m³—makes their collection and transportation costly and complex. The transportation fraction of energy required to deliver lignocellulosic crops to a biorefinery can be as high as 26%, a substantial burden compared to the 3% to 5% for grains. This logistical problem requires significant investment in new infrastructure and supply chain innovation, which further adds to the project’s risk profile.

Converting complex biomass into fuel is an inherently challenging technical process. It is also complicated by variations in feedstock quality and moisture content, which can affect the final fuel yield and necessitate adaptive processing conditions. Overcoming these challenges involves more than just refining conversion technology; it also requires establishing a new, integrated, and resilient value chain from feedstock cultivation to final delivery.

Bridging the Gap: The Essential Role of Public Financial Support

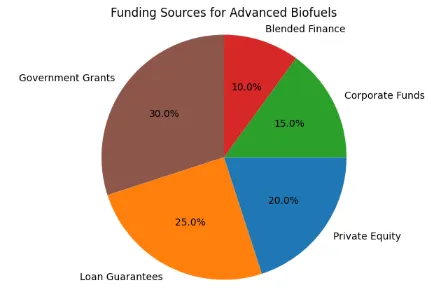

To successfully navigate the “valley of death,” the advanced biofuels industry relies on strategic public support that can absorb and mitigate risk at various stages of a project’s life cycle. Government grants, loan guarantees, and tax credits are not just subsidies; they are catalytic instruments that lay the groundwork for a self-sustaining industry.

Catalytic Grants and R&D Funding

In the initial stages of innovation, government grants serve as the primary driver of development, particularly during the period when risk is at its highest. They finance high-risk research and development that the private sector may not be willing to undertake on its own. They fund the high-risk R&D that the private sector is often unwilling to undertake alone. The Biden Administration’s Investing in America agenda has committed significant resources in the U.S. to this aim, with the Inflation Reduction Act (IRA) providing up to $9.4 million for projects that aim to enhance performance and lower costs for advanced biofuel production systems administered by agencies like the Department of Energy (DOE) and the Environmental Protection Agency (EPA), focusing on projects at the pre-pilot and pilot-test stages. Specific projects funded by these grants include converting corn stover to ethanol and capturing biogenic carbon dioxide for sustainable aviation fuel (SAF) production.

The UK provides another compelling example with its Advanced Fuels Fund (AFF), which has awarded millions in grants to projects focused on developing and commercializing SAF technologies. The third window of the AFF competition alone announced £198 million in total government contributions, with individual awards ranging from £1 million to £10 million. These grants are a critical signal of a long-term commitment to the industry, which in turn builds a strong project pipeline and attracts additional investment.

The Strategic Impact of Loan Guarantees & Blended Finance

Once a technology proves its viability, it faces the immense challenge of securing capital for commercial-scale construction. This is where loan guarantees and blended finance become critical.

Loan guarantees, like those offered by the U.S. Department of Agriculture’s (USDA) Biorefinery Assistance Program, effectively absorb a portion of the financial risk for lenders. The strategic significance of this is perfectly illustrated by the DOE’s $1.67 billion loan guarantee to Montana Renewables. A loan guarantee backed by the public will enable Montana Renewables to scale up a renewable fuels facility to annually produce 315 million gallons of biofuels, with a major emphasis on producing Sustainable Aviation Fuel (SAF). A single investment is forecast to make Montana Renewables a leading global SAF manufacturer, representing about half of North American SAF output by 2030. This loan guarantee serves as a substantial public pledge that accelerates a project from a small-scale operation to a position of global leadership, thereby reducing technological uncertainty and promoting industry-wide adoption.

Blended finance is another powerful mechanism that strategically uses public or philanthropic funds to mobilize private commercial capital. It is particularly effective for large-scale, capital-intensive projects in emerging markets where private investors perceive high risks. The European Investment Bank (EIB) provides prime examples of this model. The EIB provided a €500 million loan to Eni to convert its Livorno refinery into a biorefinery and a €430 million loan to Galp to transform its Sines Refinery to produce SAF and renewable diesel. These investments demonstrate a strategic approach that leverages existing fossil fuel infrastructure, operational expertise, and market channels, presenting a lower-risk path to commercialization compared to building entirely new greenfield facilities.

Tax Credits and Production Incentives

For long-term viability, advanced biofuels require a stable and predictable market, which is where demand-side policies and tax incentives play a decisive role. The U.S. Renewable Fuel Standard (RFS) program has been a foundational policy, mandating minimum volumes of renewable fuel to be blended into transportation fuels. However, the RFS’s statutory targets have not been consistently met, highlighting a critical lesson: mandates alone are insufficient if the underlying economic and logistical barriers are not simultaneously addressed with financial support.

The Inflation Reduction Act (IRA) attempts to correct this by coupling long-term market signals with significant financial incentives. The IRA’s Section 45Z Clean Fuel Production Credit, effective from 2025 to 2027, replaces previous technology-specific credits with a performance-based approach. This credit is calculated on a sliding scale, with larger credits for fuels that have lower lifecycle greenhouse gas emissions. For aviation fuel, the credit can be up to $1.75 per gallon if prevailing wage and apprenticeship requirements are met. A game-changing feature of the IRA is the introduction of direct pay and transferability options, which allow entities without sufficient tax liability—like startups and non-profits—to monetize their tax credits. This streamlines the project finance process and broadens the base of potential beneficiaries.

The European Union has a similar, comprehensive approach. The EU’s Innovation Fund, financed by the EU Emissions Trading System (ETS), provides grants for net-zero projects, directly linking the cost of carbon emissions to the funding of clean technologies. The Renewable Energy Directive (RED II) reinforces this policy through mandatory blending targets that necessitate advanced biofuels to make up at least 3.5% of transport energy by 2030. These policies offer a stable, long-term market signal that makes the industry more predictable and attractive to investors.

Mobilizing Private Green Funds: The Power of Strategic Partnerships

While public funding is the bedrock, private capital is essential for scaling the advanced biofuels industry to the necessary level. The most successful models for mobilizing private investment are built on innovative financial and contractual structures that share risk and align the interests of all stakeholders.

Long-Term Offtake Agreements: A Cornerstone of Project Finance

For a new biofuel production facility, demonstrating a clear path to revenue is a prerequisite for securing financing. This is the critical function of a long-term offtake agreement, a contract where a buyer agrees to purchase a portion of a producer’s upcoming goods once they are produced. These agreements are a cornerstone of project financing because they provide a promise of future income and proof of existing market demand, which makes the project appear less risky to lenders and investors.

The aviation industry, in particular, has leaned heavily on these agreements to spur the production of Sustainable Aviation Fuel (SAF). Airlines like United, American, and Southwest have entered into long-term pacts with a range of biofuel producers, securing billions of gallons of SAF over 10-20 year timeframes. For a company like Gevo, an offtake agreement with a partner like Future Energy Global is explicitly intended to help enable the financing for its new production facility. This is a powerful shift where the relationship between producers and buyers is no longer purely transactional; it has evolved into a strategic partnership. End-users are directly contributing to the financial viability of their future supply chain by providing the revenue certainty that unlocks capital for new plant construction.

The UK’s Pioneering Revenue Certainty Mechanism

To address one of the most significant barriers to advanced biofuels—revenue uncertainty—the UK has developed a particularly innovative policy: the Revenue Certainty Mechanism (RCM). Modeled on the successful Contracts for Difference (CfD) that stimulated the country’s wind power industry, the RCM provides revenue stability and protects producers from market volatility.

Under the RCM, a government-backed entity enters into a private contract with a SAF producer, agreeing on a “strike price” that is sufficient to service debt and provide a reasonable return to investors. If the market price for SAF falls below this strike price, the government-backed entity pays the difference to the producer; if it rises above the strike price, the producer pays the surplus back to the scheme. This provides a long-term guarantee of revenue, which is a critical signal for investors and lenders. In parallel, Bain Capital, a prominent global private equity firm, has made a substantial equity investment in EcoCeres, an innovative biorefinery company that converts waste biomass into a broad range of biofuels and biochemicals. This mechanism directly eliminates “offtake and price uncertainty” and is seen as one of the most favorable SAF policies in the world.

Trends in Private Equity and Corporate Climate Funds

The advanced biofuels sector is witnessing a surge in private investment, reflecting its growing importance in global decarbonization efforts. Venture capital and private equity firms are increasingly directing financial flows toward innovative biofuel technologies, particularly those focused on novel feedstocks and improved conversion efficiencies.

Specific examples illustrate this trend. The Microsoft Climate Innovation Fund, for instance, made a $50 million investment in LanzaJet to support the construction of its Freedom Pines Fuels plant in Georgia. This investment demonstrates how corporations with ambitious net-zero goals are using their capital not just to purchase a product, but to actively build out the supply chain for a product they need. Similarly, Bain Capital, a leading global private equity firm, has made a significant equity investment in EcoCeres, an innovative biorefinery company that converts waste biomass into a wide spectrum of biofuels and biochemicals. A major trend is the increasing involvement of established oil and gas companies. Major players like Eni, TotalEnergies, and Galp are acquiring or partnering with biofuel producers to integrate sustainable fuels into their energy portfolios. These companies are using their existing refinery infrastructure, operational skills, and market connections to speed up the scale-up process, offering a lower-risk way to enter the market compared to building entirely new facilities. This hybridization of legacy infrastructure with new technology represents a powerful force for rapid market transformation.

Case Studies and the Future Outlook for Advanced Biofuels

The most effective strategies for accelerating scale-up are best understood through the analysis of real-world examples.

Enerkem: Enerkem’s waste-to-biofuels plant in Edmonton, Alberta, is a seminal example of a successful public-private partnership. The project was a collaboration between Enerkem, the City of Edmonton, and the Government of Alberta. The city’s 25-year agreement to convert 100,000 metric tons of municipal solid waste annually was instrumental in de-risking the project and attracting private investment.

LanzaJet: LanzaJet’s approach is a masterclass in leveraging a multi-layered funding strategy. The company is involved in multiple projects, including its Freedom Pines Fuels plant in Georgia, supported by a $50 million investment from the Microsoft Climate Innovation Fund. This private investment is complemented by public grants, such as the £10 million provisional award from the UK’s Advanced Fuels Fund for its “Project Speedbird”.

Eni and Galp: The conversion of existing oil refineries into biorefineries is a distinct and increasingly prevalent model. The EIB has provided massive, long-term debt to fund these projects, such as a €500 million finance contract for Eni’s Livorno project. This approach leverages established assets and operational expertise to drive rapid scale-up with a lower risk profile than building entirely new facilities.

The analysis of these case studies reveals that the key to accelerating the industry lies in the strategic and cohesive deployment of a tiered funding model. Initial public grants address the high-risk, pre-commercial phase of development. These are followed by large-scale loan guarantees and blended finance that de-risk the massive capital expenditure required for commercialization. Finally, a predictable regulatory environment, fortified by production tax credits and long-term mandates, provides the market certainty that attracts and sustains private investment.

The future outlook for advanced biofuels is highly promising, provided that this coordinated approach continues. The market is projected to reach nearly a trillion dollars by 2030, reinforcing advanced biofuels as a scalable and near-term solution for deep emissions reductions. The growth anticipated in this sector is predicted to generate a substantial number of employment opportunities, with some forecasts suggesting as many as 1.9 million jobs in the U.S. economy by 2030. Advanced biofuels are emerging as a vital link between the current reliance on fossil fuels and a future based on renewable, circular energy systems, driven by the convergence of decarbonization policies, technological advancements, and an expanding investment portfolio.

China’s Rice Straw Biomethanol: Energy, Cost & Emissions

A concise look at energy use, production costs, and lifecycle emissions for rice-straw biomethanol in China.

biofuelspk.com →