The Business Case for Co-locating Advanced Biofuel Facilities with Existing Refineries

The energy landscape is changing quickly. As nations commit to ambitious climate goals, there is pressure on every sector, especially the traditional fossil fuel industry, to innovate. For decades, oil refineries have been central to our transportation and industrial economies. Now, faced with stricter regulations and a global shift toward low-carbon fuels, these complex facilities find themselves at a crucial point. They can either become outdated or reinvent themselves as key players in a sustainable energy future.

This isn’t about closing down refineries; it’s about changing them. A strong and increasingly popular strategy is to set up advanced biofuel production units alongside existing petroleum refineries. This integrated approach is not just an odd idea; it is proving to be a smart, strategic way for major energy companies. By sharing infrastructure and using decades of operational experience, co-location gives refineries a real chance to transition profitably while significantly lowering their carbon footprint. It combines economic sense with environmental necessity, creating a win-win for businesses and the planet. Let’s look into the strong business case for this transformative strategy.

Merging Biofuels and Refineries

Co-location, in the context of biofuels, means placing new biofuel production units near or next to existing petroleum refineries. This involves more than just sharing a boundary; it focuses on working closely together. The new biofuel facility can take advantage of the infrastructure, utilities, and waste streams already available at the refinery and also get more information .

Think about a typical refinery with its network of pipelines, storage tanks, processing units, and skilled workers. Now picture a new unit producing sustainable aviation fuel (SAF) or renewable diesel being smoothly integrated into this setup. This integration brings immediate benefits. For example, feedstock for biofuel production—such as used cooking oil, animal fats, or agricultural residues—can be delivered and stored using the existing infrastructure. The biofuels produced can then be blended, stored, and distributed through the refinery’s established logistics.

The advantages are numerous. Shared utilities like hydrogen, steam, and electricity cut down on the need for new facilities. Analytical labs, maintenance teams, and safety protocols can be shared, which leads to smoother operations and lower costs. This cooperative relationship turns a potential competitor into a strong partner in the shift toward lower-carbon energy.

Economic Benefits: Driving Profitability in the Energy Transition

The economic arguments for co-locating advanced biofuel facilities are compelling, offering significant advantages over building entirely new, “greenfield” biofuel plants.

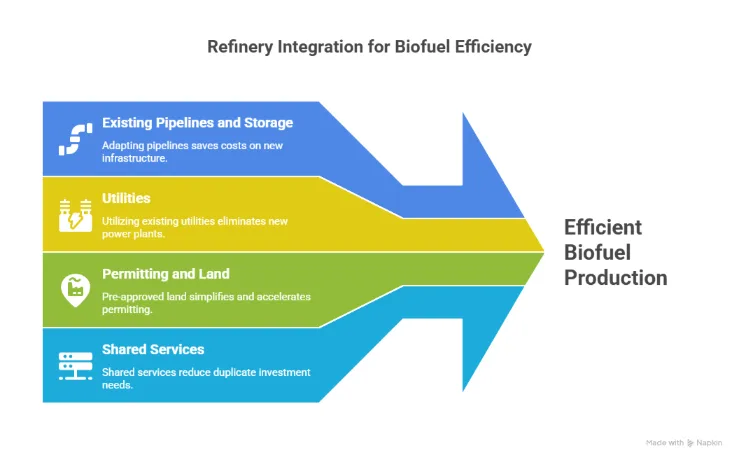

One of the most substantial benefits is the reduction in capital expenditure (CAPEX). Building a greenfield refinery or a standalone biofuel plant from scratch is an incredibly capital-intensive endeavor, requiring billions of dollars for land acquisition, permitting, civil works, and the construction of all necessary infrastructure. By co-locating, developers can tap into existing assets, significantly reducing these costs. This includes:

1. Lower Capital and Operating Costs

- Existing Pipelines and Storage: Refineries possess extensive networks for transporting and storing crude oil, refined products, and various intermediates. These can often be adapted for biofuel feedstocks and finished products, avoiding the massive cost of building new infrastructure.

- Utilities: Steam, electricity, cooling water, and industrial gases (like hydrogen) are already produced and distributed efficiently within a refinery. A co-located biofuel plant can simply tie into these existing utility grids, eliminating the need for new power plants, boilers, or water treatment facilities.

- Permitting and Land: Refineries are already industrial sites, often pre-approved for heavy industrial activity. This can dramatically simplify and accelerate the permitting process compared to finding and developing new industrial land.

- Shared Services: Facilities like control rooms, fire suppression systems, emergency response teams, security, and administrative offices are already in place, reducing the need for duplicate investments.

Furthermore, operating expenses (OPEX) are also considerably lowered. Shared maintenance teams, analytical services, and a unified operational workforce lead to greater efficiency. The ability to leverage existing supply chain relationships for chemicals and catalysts further contributes to cost savings.

2. Faster Project Timelines

Time is money, especially in fast-changing markets like biofuels. Greenfield projects are known for their long development and construction timelines. These projects often take 5 to 10 years from idea to operation because of the detailed planning, permitting, and construction needed. Co-location can speed up project timelines. By using existing permits, infrastructure, and a skilled workforce, projects can shift from planning to commissioning more quickly. This helps companies seize market opportunities sooner and achieve returns on investment faster.

3. Opportunities for Joint Ventures and Partnerships

The size and complexity of refinery operations mean that big energy companies often have the money and knowledge to make changes. However, co-location opens up opportunities for new partnerships and joint ventures. Smaller, specialized biofuel tech companies can team up with large refiners, bringing their unique processes to a well-established industrial environment. This partnership approach spreads risk, combines knowledge, and can access funding that might be hard to get for individual projects. It also lets refiners expand their portfolios without facing all the risks of technological development.

Sustainability Gains: A Pathway to Decarbonization

Beyond the compelling economics, co-location offers profound sustainability advantages, directly contributing to the decarbonization of the energy sector and helping refiners meet environmental targets.

1. Reduction in Lifecycle Emissions

Integrating biofuel production into a refinery can significantly reduce the overall lifecycle emissions of fuels. Biofuels aim to lower greenhouse gas (GHG) emissions compared to fossil fuels, especially when made from sustainable feedstocks. By producing these fuels at a refinery, companies can cut down on emissions linked to transport, such as using pipelines instead of trucks or trains. They can also make better use of energy in an already efficient facility. The low-carbon fuels produced can be easily mixed into the current fuel supply, which immediately reduces the carbon intensity of gasoline, diesel, and jet fuel.

2. Efficient Use of Refinery By-products and Utilities

One of the most elegant sustainability benefits is the potential for circularity within the refinery gates. Refineries produce various by-products or consume large amounts of energy that can be beneficially utilized by a co-located biofuel unit:

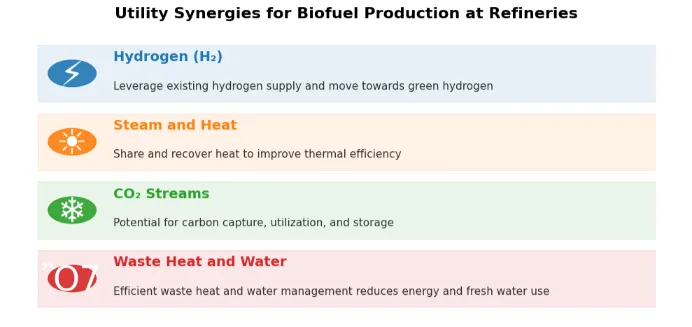

Hydrogen, steam, heat, CO₂ streams, and water management work well together when biofuel facilities are located near refineries. Hydrogen (H₂) is crucial for hydrotreatment in renewable diesel and SAF production. Refineries already produce and use a lot of hydrogen, so this setup eliminates the need for new, energy-demanding production plants. As the industry moves toward green hydrogen, the advantages of sharing this resource will grow. Refineries also produce a large amount of steam and process heat. These can be effectively shared with biofuel operations, helping to cut overall energy use and improve thermal efficiency. Co-location creates chances for carbon capture, utilization, and storage (CCUS). Concentrated CO₂ streams from biofuel processes could be captured, reused in refinery operations, or stored, which supports a more circular carbon economy. Additionally, combining waste heat and water systems reduces energy loss and lowers the need for fresh water. This significantly boosts the environmental performance of the entire site.

3. Potential to Retrofit Old Refineries for Circular, Low-Carbon Operations

Many existing refineries, some dating back decades, face an uncertain future as demand for fossil fuels is projected to decline. Co-location offers a viable and economically attractive path to retrofit and repurpose these valuable assets. Instead of decommissioning, which is costly and results in job losses, old refinery units can be converted or adapted to process sustainable feedstocks. This transformation can turn a potential liability into a strategic asset for the low-carbon economy. It also helps retain skilled labor, transitioning jobs from traditional refining to advanced biofuel production, supporting a just transition for refinery communities.

Case Studies of Refineries Leading Change: Global Pioneers

The concept of co-location is not merely theoretical; it is actively being implemented by some of the world’s largest and most forward-thinking energy companies. These pioneers are demonstrating the viability and benefits of integrating advanced biofuel production into their existing refinery footprints.

Neste (Finland/Netherlands/Singapore/USA)

Perhaps the most prominent example is Neste, a Finnish company that has become the world’s leading producer of renewable diesel and sustainable aviation fuel. Neste has strategically converted existing refinery capacity and built new, integrated facilities. Their Porvoo refinery in Finland and the Singapore refinery are prime examples where traditional petroleum refining infrastructure has been adapted and expanded for the production of biofuels from waste and residue feedstocks. They have also invested in the Martinez Renewable Fuels project in California, converting a conventional refinery into a renewable fuels facility in a joint venture. Neste’s strategy highlights the power of repurposing and scaling up biofuel production within an established industrial framework.

TotalEnergies (France)

French energy giant TotalEnergies is another leader in this space. They have transformed their Grandpuits refinery in France into a “zero-crude platform” dedicated to sustainable aviation fuel, renewable diesel, and bioplastics. This project demonstrates a complete pivot, leveraging existing infrastructure and skilled personnel to create a fully integrated bio-refinery. Similarly, their La Mède biorefinery, also in France, was converted from a conventional refinery to produce renewable diesel, showcasing how major industrial sites can be successfully repurposed.

Eni (Italy)

Italy’s Eni has been at the forefront of this transition since 2014, when it converted its Venice refinery into a biorefinery, followed by a similar conversion at Gela. These facilities produce HVO (hydrogenated vegetable oil) biofuel from various feedstocks, including used cooking oil and animal fats. Eni’s ongoing investments underscore the commitment to circularity and the strategic value of leveraging existing sites for sustainable fuel production.

Valero Energy (USA)

In the United States, Valero Energy has been a significant player. While many of their biofuel ventures have involved partnerships, their existing refinery infrastructure provides a robust backbone for integrating renewable fuel production. Projects like the Diamond Green Diesel joint venture with Neste, which operates facilities co-located with Valero refineries in Norco, Louisiana, and Port Arthur, Texas, exemplify how traditional refiners are strategically positioning themselves in the renewable fuels market by utilizing existing operational advantages.

These examples illustrate a clear trend: major global energy companies are not just exploring but actively investing in co-location and conversion projects. They recognize that their existing refineries, far from being legacy assets, can be transformed into key engines of the low-carbon future.

The Road Ahead: Policy, Profitability, and Sustainability

The journey toward widespread co-location of advanced biofuel facilities is gaining momentum, but its acceleration will depend on several critical factors, particularly policy support and continued market evolution.

1. The Role of Policy Incentives and Carbon Markets

Government policies and economic mechanisms are crucial enablers for this transition. Policy incentives, such as tax credits for renewable fuel production (e.g., the U.S. Renewable Fuel Standard (RFS), California’s Low Carbon Fuel Standard (LCFS), or European Union’s Renewable Energy Directive (RED II)), provide the necessary financial stimulus to make these projects economically viable. These policies reduce the risk for investors and help bridge the cost gap between conventional and advanced biofuels.

Carbon markets, whether cap-and-trade systems or carbon taxes, create a financial value for emissions reductions. As the cost of emitting carbon increases, the business case for investing in low-carbon solutions like co-located biofuel production becomes even stronger. These market mechanisms reward companies for reducing their carbon footprint, directly aligning sustainability goals with profitability. Consistent and long-term policy signals are essential to provide the certainty needed for the substantial investments required for refinery transformations.

2. Balancing Business Profitability with Sustainability Commitments

Ultimately, the widespread adoption of co-location strategies depends on its ability to balance business profits with sustainability commitments. For shareholders and stakeholders, the economic benefits—lower CAPEX and OPEX, faster timelines, and diversified revenue streams—are crucial. For the planet and future generations, the sustainability gains—reduced lifecycle emissions, efficient resource use, and circular economy principles—are essential.

Co-location offers a unique opportunity where these two goals come together. It enables established energy companies to use their strengths and existing resources to enter new and growing markets. This not only helps maintain their long-term importance but also allows them to contribute significantly to global efforts to reduce carbon emissions. This strategy positions them as leaders in the energy transition, attracting environmentally conscious investors and meeting the rising consumer demand for sustainable products.

Additionally, in areas facing energy security issues, domestic biofuel production at existing refineries can improve national energy independence by diversifying feedstock sources and cutting reliance on imported crude oil.

also learn more in this report

Call to Action: A Smart Business Decision for the Energy Transition

The urgent need to reduce carbon emissions in energy systems presents challenges and opportunities for refiners. Co-locating advanced biofuel facilities offers a smart solution. By working with existing refineries, companies can lower capital and operating costs, speed up project timelines, and access new revenue sources. This approach also helps reduce lifecycle emissions and make better use of by-products. Leading firms like Neste, TotalEnergies, Eni, and Valero are already demonstrating the profitability and scalability of this model. As regulations tighten and carbon markets grow, co-location is shifting from a compliance strategy to a competitive advantage. For energy companies, it has become a necessity, showing that profitability and sustainability can go together to ensure a low-carbon future.

How Financial Support and Green Funds Can Accelerate the Scale-Up of Advanced Biofuel Technologies

Explore funding models, de-risking tools, and policy levers that can speed commercialization and scale for advanced biofuels.

Read article