Europe Advanced Biofuel Market: Business Models and Strategies for 2030

As the push for 2030 decarbonization intensifies, the Europe advanced biofuel market is emerging as a critical yet complex pillar for sustainable mobility, balancing high innovation with significant economic hurdles. While cellulosic ethanol and advanced biodiesel face steep carbon abatement costs often exceeding €200 and $300/tCO2eq respectively these next-generation fuels remain indispensable for sectors where electrification is impractical. Driven by evolving EU policies and shifting business models, the market is currently transforming these practical constraints into opportunities for long-term growth, positioning advanced biofuels as a primary engine for reducing greenhouse gas emissions across the continent.

Europe Advanced Biofuel Market: A Sustainable Alternative

The EU’s Renewable Energy Directive (RED II) sets ambitious targets to increase renewable energy use in transport, with a strong focus on advanced biofuels sourced from non-food feedstocks. These include sustainable bio-jet fuels, bio-diesel, hydrotreated vegetable oil (HVO), biomethane, and power-to-liquid (PtL) fuels. Unlike first-generation biofuels that competed with food crops, advanced biofuels harness waste materials, residues, and dedicated energy crops, ensuring environmental and social sustainability.

Advanced biofuels (second-generation, from lignocellulosic materials or waste) currently have higher production costs than both fossil fuels and first-generation biofuels. By 2030, costs may approach those of first-generation biofuels, but only under favorable technological and market conditions (Oehmichen et al., 2021).

Advanced biofuels can seamlessly integrate into existing fuel infrastructure with minimal modifications, offering a practical decarbonization pathway especially for aviation, maritime shipping, and heavy freight. Early adoption helps companies meet stringent emissions targets while maintaining operational reliability.

Leading Transport Companies Driving the Biofuel Shift

European transport industry leaders are embracing advanced biofuels as part of their sustainability strategies:

- Aviation: Airlines such as Lufthansa, KLM, and SAS are integrating Sustainable Aviation Fuels (SAFs) into regular flight operations. They are investing in fuel production, partnering with biofuel producers, and exploring PtL technologies to meet and exceed regulatory blend mandates, appealing to eco-conscious travelers.

- Maritime shipping: Giants like Maersk and CMA CGM are trialing bio-diesel and biomethane for container fleets, developing green corridors, and innovating engine technologies to handle biofuel blends, aiming to drastically cut emissions from global shipping logistics.

- Road freight: Logistics providers including DHL and DB Schenker are switching to HVO and biomethane for trucks, enabling immediate emissions reductions without the need for new vehicle fleets. They are also investing in refueling infrastructure and waste-to-fuel feedstock projects to secure supply chains.

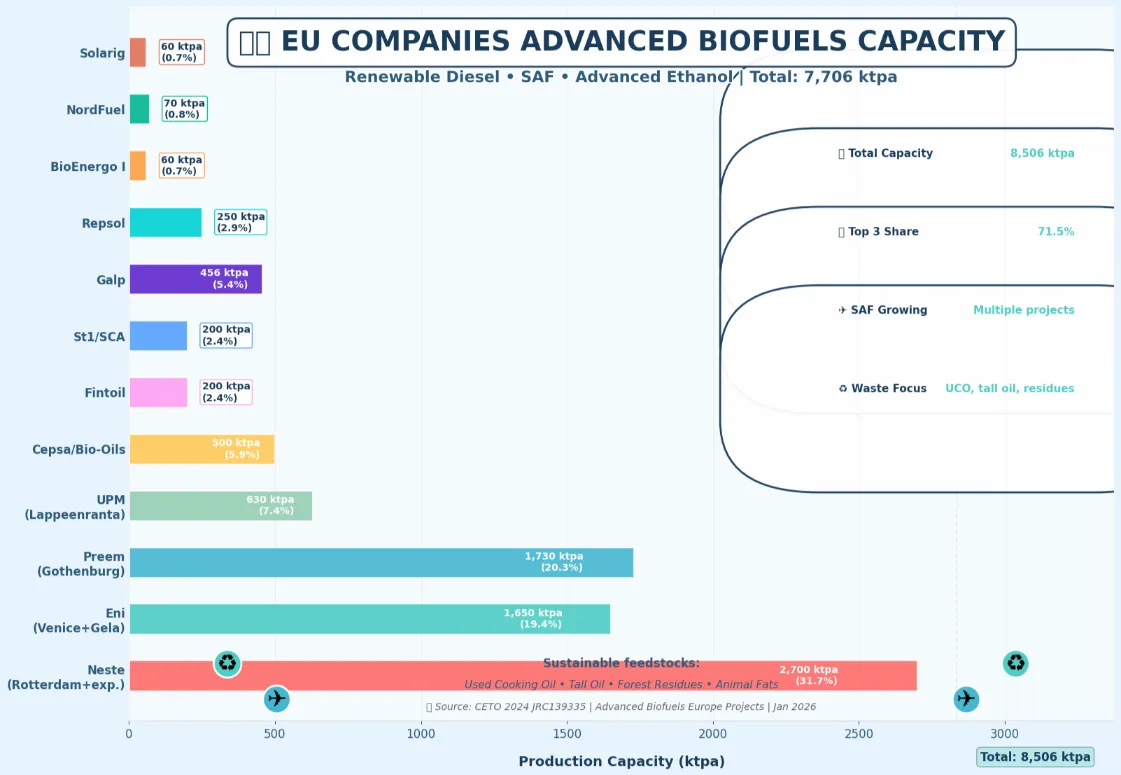

EU companies lead advanced biofuel production in Europe, with a total represented capacity of 7,706 ktpa across renewable diesel (HVO), sustainable aviation fuel (SAF), advanced ethanol, and related pathways.Different companies such as Neste dominates with 35% share (2,700 ktpa) from Rotterdam expansions, followed by Preem (22%, 1,730 ktpa) and Eni (21%, 1,650 ktpa) leveraging refinery conversions. Smaller but innovative players like UPM (8%, wood-based), Cepsa/Bio-Oils (7%, SAF focus), and Galp (6%) contribute via waste/residue feedstocks.

These companies leverage their purchasing power and brand influence to accelerate the market entry of advanced biofuels, underpinning the broader decarbonization agenda (Motola et al., 2023).

Tackling Public Perception: Building Trust and Awareness

Despite the environmental benefits, public understanding of advanced biofuels remains limited due to past controversies around first-generation biofuels. Transparent communication about sustainable feedstock sourcing especially from waste and residues—is essential to reshape perceptions.

Key public engagement strategies include:

- Educating consumers on the circular economy benefits where waste is converted into clean energy.

- Differentiating advanced biofuels clearly from earlier biofuel generations linked to deforestation and food competition.

- Using credible certifications like ISCC to build trust.

- Highlighting examples such as flights powered by fuels derived from used cooking oil to boost consumer confidence.

Effective public outreach not only fosters acceptance but also creates consumer-driven demand for sustainable transport options.

Overcoming Marketing Challenges: Making the Invisible Visible

Marketing biofuels faces inherent challenges because the environmental benefit is not physically visible in the vehicle or vessel. Companies must therefore:

- Use transparent certification to authenticate fuel sustainability.

- Quantify emissions reductions in relatable terms (e.g., tons of CO2 saved equivalent to cars taken off roads).

- Collaborate with fuel producers and partners to amplify messaging.

- Tell engaging stories about fuel production journeys from waste to wheels or wings.

- Develop “green miles” brands or labeling that enable consumers and businesses to choose and support sustainable fuel use explicitly.

Such approaches help make the value of advanced biofuels visible and compelling across diverse audiences and stakeholders.

Policy Related gaps and Interventions

| Value Chain Stage | Policy-Related Gap | Proposed Intervention |

| Biomass Supply | Limited integration of soil quality and soil carbon policies into biomass supply chains. | Support carbon farming, biochar use, cover/rotational cropping and agroforestry; deploy flagship regional initiatives to operationalise these practices. |

| Biomass Supply | Lack of uniform definition and classification of degraded land; few initiatives to rehabilitate such land for biomass. | Develop an EU-wide definition and classification of degraded land; finance phytoremediation and tailored feedstock premiums to make early low yields viable. |

| Biomass Supply | Slow mobilisation of residues and organic wastes; weak knowledge transfer from existing regional initiatives. | Create regional biomass hubs and trade centres; fund logistics and standards for waste/residue mobilisation via ERDF, Cohesion Fund and related instruments. |

| Conversion Pathways | High investment risk and limited access to finance for First-of-a-Kind plants and innovative processes. | Use green funds (EU ETS, Just Transition, InvestEU, Cohesion Policy funds) to de‑risk FoAK scale‑up and promote co‑location with existing refineries/biorefineries. |

| Conversion Pathways | Insufficient support for improving process efficiency, product quality and multi‑product biorefineries. | Provide targeted innovation and capital grants for higher‑efficiency conversion, by‑product utilisation and multi‑output biorefineries. |

| End Use | Large price gap between advanced biofuels and fossil fuels; taxation does not reflect external costs. | Increase carbon taxes on fossil fuels; reduce VAT/excise duties for advanced biofuels so that retail prices approach break‑even. |

| End Use | Weak coordination across value‑chain actors and sectors (agriculture, forestry, energy, transport). | Create platforms and governance mechanisms for cross‑sector cooperation and rapid feedback on regulation to support advanced biofuel value chains. |

The analysis reveals that the advanced biofuel value chain faces interconnected policy gaps across all three stages biomass supply, conversion pathways, and end use requiring an integrated approach. Key interventions must focus on financial de‑risking mechanisms, Ultimately, successful deployment will depend on establishing coordinated governance platforms that align agricultural, industrial, and energy policies, while supporting regional biomass availability and infrastructure adaptation through various funding opportunities.

Financial Incentives: Essential for Market Growth and Investment

Advanced biofuels currently incur higher production costs than fossil fuels, making financial incentives vital to close the price gap and drive scale. Key mechanisms supporting adoption include:

- Tax reductions or exemptions on sustainable biofuels.

- Binding blending mandates and tradable renewable fuel certificates.

- Grants and subsidies for building advanced bio-refineries.

- Carbon pricing mechanisms such as Emissions Trading Systems expanding to shipping and road transport.

- Public procurement policies favoring biofuel use in government fleets.

These incentives de-risk investments, stabilize the market, and create financial viability for producers and transport companies alike.

EU-REPORT

Public RDSI Funding and Investments

Public research, development, and innovation (RD&I) funding and investments are a cornerstone of the European Union’s strategy to accelerate the development and deployment of advanced biofuels. At EU level, public funding is mainly running through framework such as Horizon 2020 and Horizon Europe, complemented by national RD&I schemes. These initiatives support the entire biofuel value chain, including sustainable feedstock supply, pre-treatment technologies, conversion pathways, fuel upgrading, and integration into existing transport infrastructures. Between 2020 and 2021, public RD&I in liquid biofuels in the EU averaged around EUR 50 million per year, Showing a steady path to maintaining innovation capacity. A significant increase was observed in 2022, when public funding rose to approximately EUR 250 million, largely allocated to unallocated or cross-cutting biofuel categories.

Technology Readiness for Europe Advanced Biofuel Market

Technological readiness for the European advanced biofuel market is measured by Technology Readiness Level (TRL) framework from 1 to 9, where TRL 1 corresponds to basic principles observed and TRL 9 to an actual system proven in operational conditions. Within this parameter, key pre-treatment and conversion steps relevant for advanced biofuels have already reached high TRL levels, such as pyrolysis of biomass to pyrolysis oil, gasification of biomass and pyrolysis oil to syngas, hydroprocessing of oils, fats and bio-liquid intermediates, transesterification of triglycerides, biomethane from biogas upgrading and catalytic methanation of syngas for synthetic natural gas. Other pre-treatment routes and novel pathways, such as hydrothermal liquefaction to bio-crude, oil extraction from algae, dark and light fermentation to hydrogen, gas fermentation to alcohols, aqueous phase reforming of sugars to hydrogen, fast pyrolysis thermo‑catalytic reforming to drop‑in fuels, lignocellulosic biomass to Fischer–Tropsch fuels, lignocellulosic biomass to ethanol and aquatic biomass to advanced biofuels, are in intermediate TRL ranges and still need optimisation and scale‑up before full commercial deployment.

Securing Sustainable Feedstock Supply Chains

Feedstock availability is the foundation for scaling advanced biofuels sustainably. These sources include:

- Agricultural and forestry residues (straw, wood chips, thinnings).

- Used cooking oil and animal fats (waste streams).

- Municipal solid waste and industrial waste.

- Algae (emerging R&D feedstock).

- Dedicated energy crops grown on marginal, non-arable land.

Collaborations between biofuel producers, waste managers, farmers, and forestry industries optimize collection and logistics, while sustainability certifications prevent competition with food production or land-use change. Investment in strategically located bio-refineries near feedstock sources is critical to cost-effective supply chain development.

The Road Ahead: A Transformative Decade for European Transport

Aviation and maritime sectors are prioritized for advanced biofuels due to limited electrification options, but the cost gap with fossil fuels persists. For example, renewable jet fuel costs are projected to remain €7–13/GJ higher than fossil jet fuel by 2030, requiring policy mechanisms to bridge the gap (Carvalho et al., 2021).

By 2030, advanced biofuels will be a cornerstone of Europe’s decarbonized transport ecosystem, especially in sectors where electrification faces barriers. This transition will unlock innovative business models, from integrated green supply chains and circular logistics to carbon offsetting schemes linked to biofuel use.

Europe’s transport industry is poised for a green revolution where advanced biofuels are not just an alternative fuel but a strategic enabler of sustainable economic growth and a cleaner mobility future. The challenge lies in coordinated efforts across policy, industry, public engagement, investment, and innovation to ensure these fuels achieve their full potential.

CITATIONS

De Jong, S., Van Stralen, J., Londo, M., Hoefnagels, R., Faaij, A., & Junginger, M. (2018). Renewable jet fuel supply scenarios in the European Union in 2021–2030 in the context of proposed biofuel policy and competing biomass demand. GCB Bioenergy, 10, 661 – 682. https://doi.org/10.1111/gcbb.12525.

Oehmichen, K., Majer, S., & Thrän, D. (2021). Biomethane from Manure, Agricultural Residues and Biowaste—GHG Mitigation Potential from Residue-Based Biomethane in the European Transport Sector. Sustainability. https://doi.org/10.3390/su132414007.

Carvalho, F., Portugal-Pereira, J., Junginger, M., & Szklo, A. (2021). Biofuels for Maritime Transportation: A Spatial, Techno-Economic, and Logistic Analysis in Brazil, Europe, South Africa, and the USA. Energies. https://doi.org/10.3390/en14164980.

MOTOLA, V., REJTHAROVA, J., SCARLAT, N., HURTIG, O., BUFFI, M., GEORGAKAKI, A., … & SCHADE, B. (2023). Clean Energy Technology Observatory: Advanced Biofuels in the European Union-2024 Status Report on Technology Development, Trends, Value Chains and Markets.

Financing Opportunities for First-of-a-Kind Advanced Biofuel Plants