Clean Shipping’s Secret Weapons? Why Biomethanol Is Gaining Momentum On The Seas

Clean Shipping’s Secret Weapons?

Why Biomethanol Is Gaining Momentum On The Seas

Clean Shipping’s Secret Weapons? Why Biomethanol Is Gaining Momentum On The Seas

What Is Biomethanol?

Biomethanol is a renewable form of methanol created from sustainable biomass sources such as forestry and agricultural waste, municipal solid waste, and biogas. Unlike standard methanol made from fossil fuels, biomethanol provides a cleaner, circular option that can greatly lower greenhouse gas (GHG) emissions throughout its lifecycle.

Key Properties

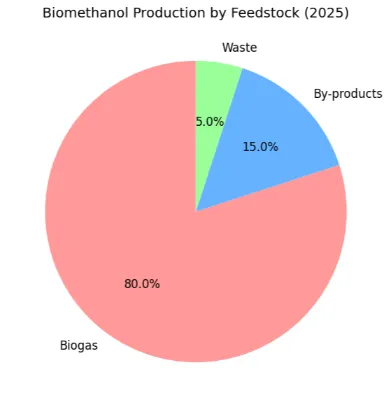

- Renewable Feedstocks: Forestry and agricultural waste, biogas, sewage sludge, municipal solid waste, and black liquor.

- Production Process: Gasification or anaerobic digestion of biomass, followed by synthesis into methanol.

- Compatibility: Can be used in existing or modified engines, often in dual-fuel setups.

Why Biomethanol? The Shipping Industry’s Secret Weapon

- Decarbonization Powerhouse

Biomethanol can cut CO2 emissions by 60% to 95% compared to traditional marine fuels, depending on the feedstock and production method. For instance, Maersk’s recent supply agreement with LONGi Green Energy Technology guarantees biomethanol with at least 65% lower lifecycle GHG emissions than fossil fuels. - Regulatory Tailwinds

The EU’s FuelEU Maritime Regulation and the Emissions Trading System (ETS) are creating competitive conditions for bio- and e-methanol, making them financially attractive compared to fossil marine fuels. Non-compliance costs for fossil fuels are set to rise from €39 per tonne in 2025 to €1,997 per tonne by 2050, encouraging quicker adoption of sustainable alternatives. - Technological Readiness and Infrastructure

Methanol is already handled and bunkered in over 120 ports around the world. This makes the switch to biomethanol relatively simple compared to other alternative fuels. Major shipbuilders and engine manufacturers are producing dual-fuel vessels that can operate on both conventional and green methanol. - Operational Flexibility

Biomethanol can be blended with regular methanol or used as a primary fuel in dual-fuel engines. This gives shipping companies flexibility during the transition, reducing the risk of becoming locked into a single technology and supporting gradual fleet decarbonization.

Latest Facts and Figures: Biomethanol’s Rapid Rise

Market Growth

- Market Size: The global biomethanol market was valued at $95.2 million in 2023 and is projected to reach $925.84 million by 2029, showing a remarkable CAGR of 46.1%.

- Green Methanol Ships: The green methanol ships market is anticipated to grow from $4.29 billion in 2025 to $30.98 billion by 2035, at a CAGR of 21.9% from 2025 to 2035.

- Vessel Orders: DNV predicts the number of methanol-fueled vessels will increase from 50 in 2024 to over 360 by 2028, with major companies like Maersk and X-Press Feeders leading the way.

Emissions Impact

- Lifecycle Emissions: Biomethanol can reduce lifecycle GHG emissions by up to 65% compared to conventional marine fuels.

- Net-Zero Voyages: The world’s first net-zero voyage using a mix of ISCC-certified bio-methanol and natural gas-based methanol was completed by Methanex and MOL’s Cajun Sun in early 2023, proving its feasibility.

Regulatory and Infrastructure Developments

- FuelEU Maritime: Emission reduction targets for shipping escalate every five years, starting at 2% in 2025 and reaching 80% by 2050, which can be met through methanol blends.

- Bunkering Hubs: Ports like Rotterdam, Singapore, Bremen, Bremerhaven, Shanghai, and Ulsan are actively working on developing or expanding methanol bunkering infrastructure.

- Simultaneous Operations: In May 2025, Singapore’s X-Press Feeders achieved the first simultaneous refueling of a container ship with bio-methanol while loading cargo, showcasing operational maturity and efficiency.

Case Studies: Biomethanol in Action

1. Maersk’s Methanol Fleet

Maersk, the largest container shipping company globally, aims for carbon neutrality by 2050. All new container vessels will feature dual-fuel engines that can run on green methanol. As of late 2024, Maersk operates seven methanol dual-fuel ships and has secured supply agreements for bio-methanol to meet 50% of its fleet’s needs by 2027.

2. Cajun Sun’s Net-Zero Voyage

In early 2023, the dual-fuel tanker Cajun Sun, operated by Methanex’s Waterfront Shipping and chartered from MOL, completed the first net-zero trans-Atlantic voyage using a blend of bio-methanol and natural gas-based methanol. The 18-day journey from Geismar, U.S., to Antwerp, Belgium, proved that net-zero emissions are currently achievable with biomethanol.

3. X-Press Feeders’ Operational Milestone

In May 2025, X-Press Feeders in Singapore completed the world’s first simultaneous refueling of a container ship with bio-methanol while loading cargo, cutting turnaround time and emissions. The company is adding 14 dual-fuel vessels that can operate on both regular fuel and green methanol, built by Yangzijiang Shipbuilding.

Economic and Environmental Analysis

Cost Competitiveness

- Current Costs: Currently, biomethanol’s levelized cost of shipping (LCOS) is higher than diesel, but with carbon pricing and regulatory penalties on fossil fuels, it is expected to become more competitive, potentially falling below diesel and LNG in some cases.

- EU Market Pricing: The average maximum price for biomethanol is estimated to be €1,193 per tonne from 2025 to 2050, while e-methanol is projected at €2,238 per tonne from 2025 to 2033 and €1,325 per tonne from 2034 to 2050.

Environmental Impact

- GHG Reductions: Biomethanol can lower lifecycle GHG emissions by 37% to 65%, depending on the route, feedstock, and operational methods.

- Lifecycle Analysis: Studies indicate that with carbon taxes and regulatory incentives, biomethanol’s environmental and economic performance outperforms that of diesel and LNG.

Challenges and Barriers

- Supply and Scalability

Though biomethanol is growing quickly, production capacity is still behind demand, particularly under strict sustainability criteria. A significant increase in sustainable biofuel production is necessary to meet the shipping industry’s long-term requirements. - Feedstock Sustainability

Finding enough sustainable biomass without affecting food production or ecosystems is a concern. Environmental groups caution that increased biofuel demand could lead to land-use changes and raise food prices if not carefully managed. - Cost and Policy Uncertainty

While new regulations are generating incentives, high costs and limited supply might slow down adoption if not addressed through coordinated policy and industry efforts.

The Road Ahead: Biomethanol’s Role in Clean Shipping

Regulatory Momentum

With the IMO and EU imposing strict emissions targets and penalties, biomethanol is set to be an important compliance tool for shipping companies wanting to avoid hefty fines and meet global decarbonization goals.

Industry Collaboration

More collaboration among shipowners, suppliers, and policymakers is crucial to increase production, stabilize costs, and ensure a sustainable supply chain.

Technological Innovation

Improvements in dual-fuel engine technology, bunkering infrastructure, and supply chain efficiency are making biomethanol a viable, near-term option for clean shipping.

Conclusion: Biomethanol’s Momentum Is Real

Biomethanol has moved beyond being a niche option. It is quickly scaling, technologically ready, and becoming more cost-competitive for the shipping industry’s efforts to reduce carbon emissions. With strong regulatory backing, successful operational examples, and growing investment, biomethanol is set to be key in the future of clean shipping.

For more information on the green methanol ships market, see this detailed report from Fortune Business Insights.

Want to Learn More About Sustainable Shipping Solutions?

Subscribe to our newsletter for the latest updates on clean shipping technologies and industry trends.

Subscribe Now